Here's Why I Think HV Bancorp (NASDAQ:HVBC) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like HV Bancorp (NASDAQ:HVBC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for HV Bancorp

HV Bancorp's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that HV Bancorp grew its EPS from US$0.54 to US$3.43, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

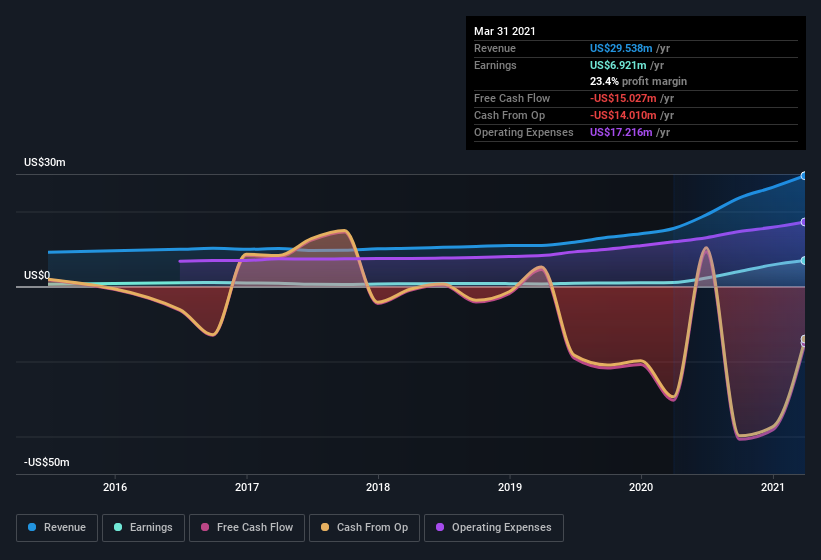

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that HV Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. HV Bancorp maintained stable EBIT margins over the last year, all while growing revenue 91% to US$30m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since HV Bancorp is no giant, with a market capitalization of US$44m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are HV Bancorp Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it HV Bancorp shareholders can gain quiet confidence from the fact that insiders shelled out US$495k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. It is also worth noting that it was Lead Independent Vice-Chairman Robert Marino who made the biggest single purchase, worth US$174k, paying US$18.00 per share.

Is HV Bancorp Worth Keeping An Eye On?

HV Bancorp's earnings have taken off like any random crypto-currency did, back in 2017. Growth investors should find it difficult to look past that strong EPS move. And in fact, it could well signal a fundamental shift in the business economics. For me, this situation certainly piques my interest. We don't want to rain on the parade too much, but we did also find 1 warning sign for HV Bancorp that you need to be mindful of.

The good news is that HV Bancorp is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance