Here's Why I Think Enstar Group (NASDAQ:ESGR) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Enstar Group (NASDAQ:ESGR). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Enstar Group

How Fast Is Enstar Group Growing Its Earnings Per Share?

In the last three years Enstar Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, Enstar Group's EPS soared from US$50.79 to US$65.75, in just one year. That's a impressive gain of 29%. We should also note that the company has boosted EPS by buying back shares, showing the strength of its balance sheet.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Enstar Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Enstar Group's EBIT margins have actually improved by 20.5 percentage points in the last year, to reach 69%, but, on the flip side, revenue was down 24%. That falls short of ideal.

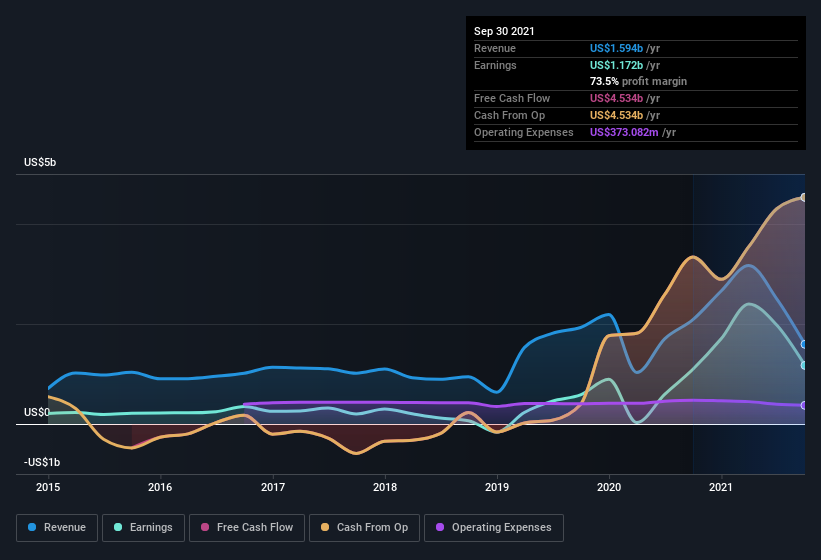

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Enstar Group's balance sheet strength, before getting too excited.

Are Enstar Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first; I didn't see insiders sell Enstar Group shares in the last year. But the really good news is that Independent Chairman of the Board Robert Campbell spent US$448k buying stock stock, at an average price of around US$224. Big buys like that give me a sense of opportunity; actions speak louder than words.

The good news, alongside the insider buying, for Enstar Group bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enormous stake in the company, worth US$249m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Does Enstar Group Deserve A Spot On Your Watchlist?

You can't deny that Enstar Group has grown its earnings per share at a very impressive rate. That's attractive. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing Enstar Group's ROE with industry peers (and the market at large).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Enstar Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance