Here's Why We Think Austco Healthcare (ASX:AHC) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Austco Healthcare (ASX:AHC). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Austco Healthcare

Austco Healthcare's Improving Profits

Over the last three years, Austco Healthcare has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, Austco Healthcare's EPS soared from AU$0.0088 to AU$0.014, over the last year. That's a commendable gain of 62%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Austco Healthcare is growing revenues, and EBIT margins improved by 6.2 percentage points to 8.5%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

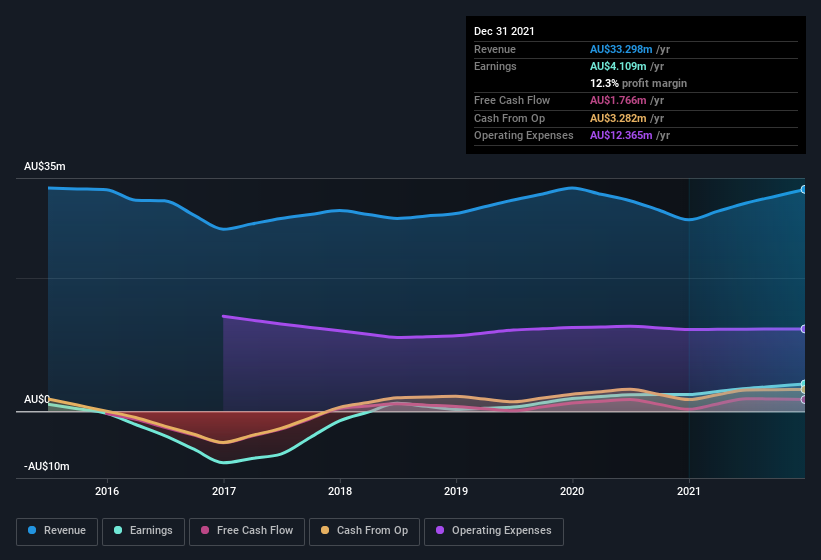

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Austco Healthcare isn't a huge company, given its market capitalization of AU$29m. That makes it extra important to check on its balance sheet strength.

Are Austco Healthcare Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last twelve months Austco Healthcare insiders spent AU$70k on stock; good news for shareholders. While this isn't much, we also note an absence of sales. We also note that it was the Independent Non-Executive Director, J. Burns, who made the biggest single acquisition, paying AU$40k for shares at about AU$0.15 each.

On top of the insider buying, we can also see that Austco Healthcare insiders own a large chunk of the company. Actually, with 47% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only AU$29m Austco Healthcare is really small for a listed company. So despite a large proportional holding, insiders only have AU$13m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Is Austco Healthcare Worth Keeping An Eye On?

For growth investors like me, Austco Healthcare's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Austco Healthcare , and understanding them should be part of your investment process.

The good news is that Austco Healthcare is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance