Here's Why I Think Armstrong World Industries (NYSE:AWI) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Armstrong World Industries (NYSE:AWI). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Armstrong World Industries

Armstrong World Industries's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Armstrong World Industries's stratospheric annual EPS growth of 41%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

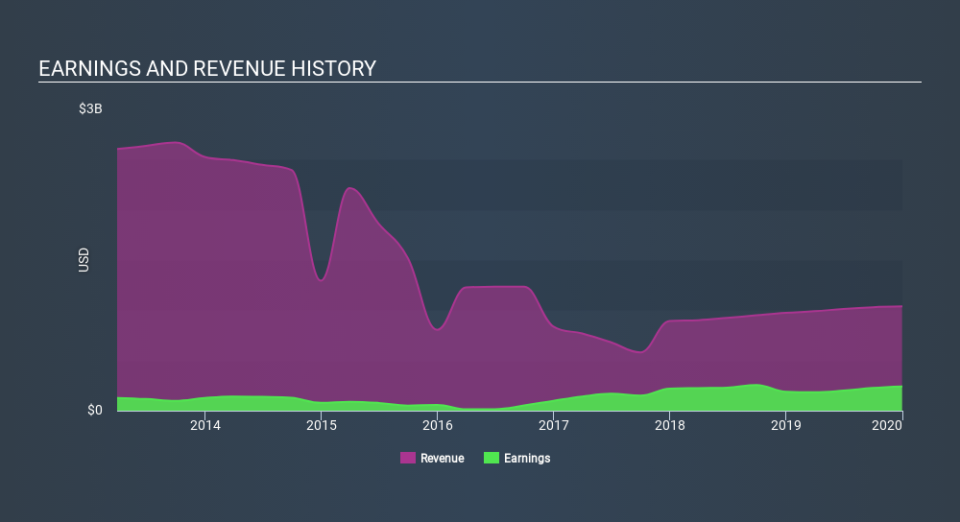

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Armstrong World Industries maintained stable EBIT margins over the last year, all while growing revenue 6.4% to US$1.0b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Armstrong World Industries's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Armstrong World Industries Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Armstrong World Industries insiders have a significant amount of capital invested in the stock. To be specific, they have US$38m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.9% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Armstrong World Industries To Your Watchlist?

Armstrong World Industries's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Armstrong World Industries for a spot on your watchlist. Still, you should learn about the 2 warning signs we've spotted with Armstrong World Industries .

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance