Here's Why Shareholders May Want To Be Cautious With Increasing Full House Resorts, Inc.'s (NASDAQ:FLL) CEO Pay Packet

Key Insights

Full House Resorts' Annual General Meeting to take place on 9th of May

CEO Dan Lee's total compensation includes salary of US$600.0k

The total compensation is similar to the average for the industry

Full House Resorts' EPS declined by 99% over the past three years while total shareholder loss over the past three years was 46%

In the past three years, the share price of Full House Resorts, Inc. (NASDAQ:FLL) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also lacking, despite revenue growth. Shareholders will have a chance to take their concerns to the board at the next AGM on 9th of May and vote on resolutions including executive compensation, which studies show may have an impact on company performance. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

View our latest analysis for Full House Resorts

Comparing Full House Resorts, Inc.'s CEO Compensation With The Industry

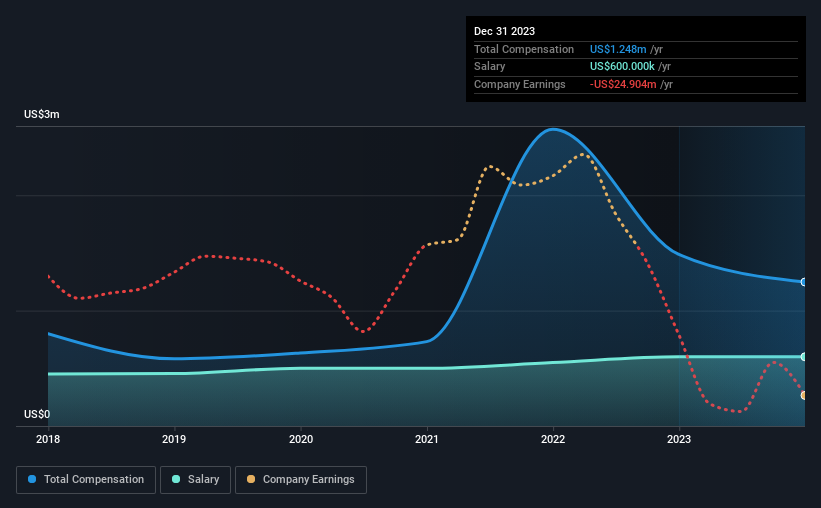

At the time of writing, our data shows that Full House Resorts, Inc. has a market capitalization of US$170m, and reported total annual CEO compensation of US$1.2m for the year to December 2023. We note that's a decrease of 16% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$600k.

For comparison, other companies in the American Hospitality industry with market capitalizations ranging between US$100m and US$400m had a median total CEO compensation of US$1.4m. So it looks like Full House Resorts compensates Dan Lee in line with the median for the industry. What's more, Dan Lee holds US$7.3m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2023 | 2022 | Proportion (2023) |

Salary | US$600k | US$600k | 48% |

Other | US$648k | US$887k | 52% |

Total Compensation | US$1.2m | US$1.5m | 100% |

Talking in terms of the industry, salary represented approximately 17% of total compensation out of all the companies we analyzed, while other remuneration made up 83% of the pie. Full House Resorts pays out 48% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Full House Resorts, Inc.'s Growth

Over the last three years, Full House Resorts, Inc. has shrunk its earnings per share by 99% per year. In the last year, its revenue is up 48%.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Full House Resorts, Inc. Been A Good Investment?

With a total shareholder return of -46% over three years, Full House Resorts, Inc. shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Full House Resorts that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance