Here's Why You Should Retain WEX Stock in Your Portfolio Now

WEX Inc. WEX has an impressive Growth Score of A. This style score condenses all the essential metrics from the company’s financial statements to get a true sense of quality and sustainability of growth. For 2021, earnings and revenues are expected to grow at a rate of 42.7% and 16.8%, respectively, on a year-over-year basis. The company has an expected long-term (three to five years) earnings per share (EPS) growth rate of 27.2%.

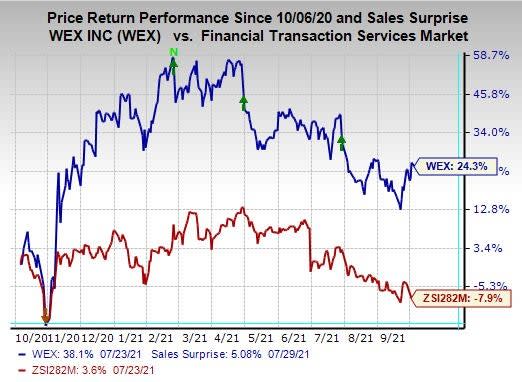

The stock has rallied 24.3% in the past year against a 7.9% loss of the industry it belongs to.

Image Source: Zacks Investment Research

Factors That Auger Well

Acquisitions have acted as a key growth catalyst for the company. WEX has been actively acquiring and investing in businesses, both in the United States as well as internationally, to expand its product and service offerings. These factors have been contributing to revenue growth and enhancing scalability. The recent acquisition of benefitexpress is expected to extend WEX’s health and employee benefits’ products and services across the employer clients. In 2020, WEX acquired eNett and Optal, which have strengthened the company’s position in the global travel marketplace.

WEX’s top line continues to grow organically driven by its extensive network of fuel and service providers, transaction volume growth, product excellence, marketing capabilities, sales force productivity and other strategic revenue generation efforts. Robust demand for its payment processing, account servicing and transaction processing services along with operational efficiency has helped WEX achieve solid revenue and earnings growth.

Primary Concern

WEX’s cash and cash equivalent balance of $1 billion at the end of second-quarter 2021 was well below the long-term debt level of $2.9 billion. This underscores that the company doesn’t have enough cash to meet this debt burden. Nevertheless, the cash level can meet the short-term debt of $146 million.

Zacks Rank & Stocks to Consider

WEX currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Zacks Business Services sector are ManpowerGroup Inc. MAN, Equifax EFX and Genpact Limited G, each carrying a Zacks Rank #2 (Buy).

Long-term expected EPS growth rate for ManpowerGroup, Equifax and Genpact is pegged at 24.2%, 14.9% and 14.7%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

WEX Inc. (WEX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance