Here's Why You Should Retain Hess Corp. (HES) Stock for Now

Hess Corporation HES is well poised to grow on the back of robust offshore Guyana oil reserves and solid midstream business.

Hess Corp. — with a market cap of $17.5 billion — is a global integrated energy company. The New York-based company engages in exploration, production, development, transportation, and purchase and sale of crude oil, natural gas liquids, and natural gas. Moreover, it is involved in gathering, compressing, and processing natural gas as well as fractionating natural gas liquids (NGLs). Additionally, Hess offers gathering, terminaling, loading and transporting operations for both crude oil and NGLs.

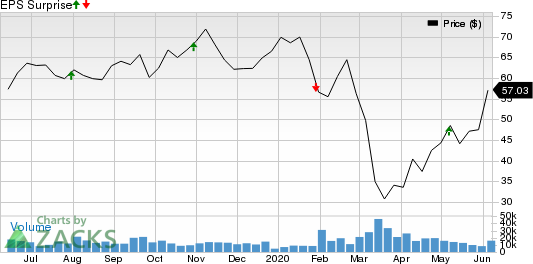

It beat earnings estimates twice, met once, and missed once in the last four quarters, with average positive surprise of 2.6%.

Hess Corporation Price and EPS Surprise

Hess Corporation price-eps-surprise | Hess Corporation Quote

Courtesy of solid prospects, this Zacks Rank #3 (Hold) stock is worth holding on to at the moment.

What’s Driving the Stock?

The company made world-class oil discoveries at the Stabroek Block, located off the coast of Guyana. It estimates gross resources of more than 8 billion barrels of oil equivalent from its 16 promising discoveries in the Stabroek Block. The discoveries made so far on the block have the potential to add five FPSO vessels that will be capable of yielding 750,000 barrels of oil per day by 2025. Hess is expected to record significant production from the Guyana prospect in the coming years. Notably, despite delays in operations owing to the coronavirus pandemic, the company expects the Liza Phase 2 development to remain on schedule and commence production in 2022.

It expects 2020 exploration and production capital and exploration expenditure to be $1.9 billion, down 37% from the original guidance of $3 billion. Despite lower capital spending, the company expects production volumes to increase on operational efficiency. Through 2020, Hess expects net production volumes — excluding Libya — to be 320,000 barrels of oil equivalent per day (Boe/d), indicating an increase from the 2019 level of 290,000 Boe/d.

Hess has implemented a cost-reduction program, through which the company will likely boost profitability and cash margins. From 2017 through 2023, it estimates cash unit production costs to decline 30%. This will provide a northbound thrust to the company’s bottom line.

Its midstream assets, which enable it to earn stable fee-based revenues, are a huge positive. From the midstream business, the company generated adjusted net earnings of $61 million in the first quarter, significantly up from $37 million a year ago due to higher throughput volumes.

Downsides

However, there are a few factors that are impeding the growth of the stock lately.

As of Mar 31, 2020, the company had $2,080 million in cash & cash equivalents. Its long-term debt rose to $8,191 million at first quarter-end from $7,142 million in the fourth quarter. The debt to capitalization at the end of the quarter was 50.8%, higher than industry average of 40.3%. The ratio has mostly been higher than the industry over the past few years. This represents that its balance sheet is more leveraged than the industry. This can affect the company’s financial flexibility.

The noticeable revenue decline in the March quarter and unfavorable upstream business scenario due to the coronavirus pandemic raise questions over the explorer’s ability to pay the portion of its long-term debt that is due for payment after 12 months.

Oil prices are now in the bearish territory owing to coronavirus-hit global energy demand and oversupplied commodity market. Weak crude prices, which are unlikely to recover soon, are thereby affecting the company’s upstream business.

Total costs and expenses rose nearly 4% through 2019 to $6,238 million. Even in first-quarter 2020, total costs and expenses rose to $3,814 million from $1,430 million in first-quarter 2019. Operating expenses for the first quarter totaled $303 million, up 13.9% from the year-ago figure of $266 million. This trait can affect the company’s profit levels in the coming days.

To Sum Up

Despite significant prospects as mentioned above, high debt burden and weak commodity prices are concerns for the company. Nevertheless, we believe that systematic and strategic plan of action will drive its long-term growth.

Key Picks

Some better-ranked players in the energy space include Chesapeake Energy Corporation CHK, CNX Resources Corporation CNX and Comstock Resources, Inc. CRK, each holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chesapeake Energy delivered an average positive earnings surprise of 42.8% in the last four quarters.

CNX Resources beat earnings estimates thrice and met once in the last four quarters, with average positive surprise of 111.5%.

Comstock Resources’ 2020 sales are expected to gain 33.7% year over year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chesapeake Energy Corporation (CHK) : Free Stock Analysis Report

Comstock Resources, Inc. (CRK) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

CNX Resources Corporation. (CNX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance