Here's Why You Should Retain Accuray (ARAY) Stock for Now

Accuray Incorporated ARAY is well-poised for growth in the coming quarters, courtesy of continued solid demand for its products. The optimism led by the second quarter of fiscal 2024 performance and potential in Precision Treatment Planning System (TPS) are expected to contribute further. However, overdependence on technologies and stiff competition persists.

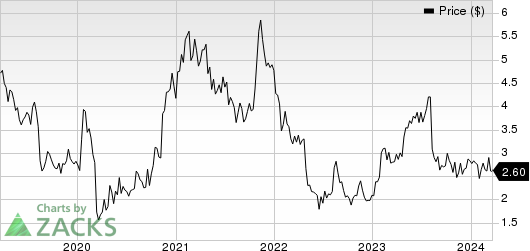

Over the past year, this Zacks Rank #3 (Hold) stock has lost 10.7% against the 9.2% rise of the industry. The S&P 500 has witnessed 28.6% growth in the said time frame.

The renowned radiation oncology company has a market capitalization of $275.7 million. Accuray projects 50% growth for fiscal 2024, in which it expects to maintain its strong performance. The company’s P/S ratio of 0.6 is favorable to the industry’s 3.5.

Image Source: Zacks Investment Research

Let’s delve deeper.

Solid Product Demand: We are optimistic about Accuray's products since, over the past few months, they have seen strong client acceptance. On the second quarter fiscal 2024 earnings call in January, management confirmed that the company witnessed a strong global demand for installations. At the quarter-end, its global installed base of systems increased year over year. The Asia-Pacific (APAC) market recently reached the 250 systems installed milestone and continues to be one of Accuray's fastest-growing installed base regions.

The same month, Accuray announced that the Providence Swedish Radiosurgery Center in Seattle, WA, is enhancing its cancer treatment capabilities with the purchase of the latest generation CyberKnife S7 System.

Potential in Precision TPS: We are optimistic about the Accuray Precision TPS, which offers an efficient way for clinicians to create high-quality radiation therapy treatment plans for various cases. It includes features such as multi-modality image fusion with a unique deformable image registration algorithm, a comprehensive set of contouring tools, and options for AutoSegmentation auto contouring for specific body areas.

Strong Q2 Results: Accuray’s second-quarter fiscal 2024 performance raises our optimism. It witnessed solid Services revenues. Geographically, Accuray’s performance was strong in EIMEA (Europe, India, the Middle East and Africa), with 30% order growth and 11% revenue growth year over year. Additionally, there was a solid year-over-year order increase in the APAC area, with China leading the way. The global installed base is growing, which is encouraging.

Downsides

Tough Competition: Rapid technological advancements and fierce rivalry characterize the medical device sector in general and the non-invasive cancer treatment sector in particular. Accuray must convince physicians and other healthcare decision-makers about the benefits of its products and technology. To compete successfully, the company needs to highlight the advantages of its products over other well-established alternative products.

Overdependence on Technologies: Achieving consumer and third-party payor acceptance of the CyberKnife and TomoTherapy platforms as preferred methods of tumor treatment is crucial to Accuray’s continued success. The possibility of Accuray’s products not gaining significant market acceptance among consumers and healthcare payors despite substantial time and expenses being spent on their education can weigh on the company’s performance.

Estimate Trend

Accuray has been witnessing a positive estimate revision trend for fiscal 2024. Over the past 90 days, the Zacks Consensus Estimate for its earnings has moved from a loss of 7 cents per share to a loss of 5 cents per share.

The Zacks Consensus Estimate for third-quarter fiscal 2024 revenues is pegged at $114.6 million, suggesting a 2.9% decline from the year-ago reported number.

Accuray Incorporated Price

Accuray Incorporated price | Accuray Incorporated Quote

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 58.3% compared with the industry’s 18.9% rise in the past year.

Cardinal Health, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 51.9% compared with the industry’s 3.2% rise in the past year.

Cencora, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have rallied 51.5% compared with the industry’s 3.6% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance