Here's Why Investors Should Avoid Altra Industrial Stock Now

We have issued an updated research report on Altra Industrial Motion Corp. AIMC on Jul 15.

The company currently carries a Zacks Rank #4 (Sell). Its market capitalization is approximately $2.1 billion.

Let’s delve deeper and discuss what led to its poor investment appeal.

Share Price Performances & Earnings Estimate Revision: Market sentiments have been against Altra Industrial for quite some time now. Its stock price has decreased roughly 0.9% in the past three months against the industry’s growth of 1.1%.

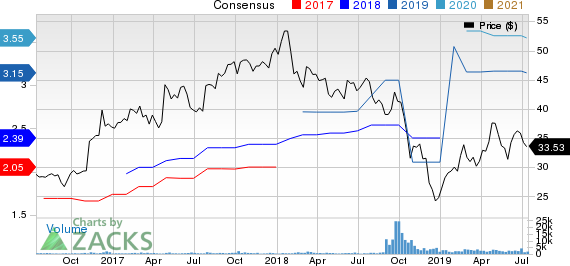

Also, it is worth noting that shares of the company have lost 10.9% since the release of first-quarter 2019 results on Apr 26, 2019. Furthermore, earnings estimates for Altra Industrial for 2019 and 2020 have been lowered in the past 60 days. Currently, the Zacks Consensus Estimate for the company’s earnings is pegged at $3.15 for 2019 and $3.55 for 2020, reflecting declines of 0.6% and 0.8% from the respective 60-day-ago numbers.

Altra Industrial Motion Corp. Price and Consensus

Altra Industrial Motion Corp. price-consensus-chart | Altra Industrial Motion Corp. Quote

Higher Costs and Expenses: Altra Industrial’s cost of sales increased 85.3% year over year in the first quarter of 2019 while its selling, general and administrative expenses grew 82.4%. In addition, the company’s research and development expenses expanded 135.4%.

We believe that tariffs, inflation in commodity prices, higher logistics and rise in freight costs might further result in a hike in the cost of sales. This, along with higher operating expenses, if uncontrolled, can affect the company’s margins and profitability. However, pricing actions might come in as a relief.

Forex Woes: Geographical diversification exposed Altra Industrial to headwinds arising from geopolitical issues, macroeconomic challenges and unfavorable movements in foreign currencies. Notably, forex woes lowered sales by 3.2% in the first quarter of 2019.

The company expects unfavorable movements in foreign currencies to adversely impact results in the second quarter of 2019.

High Debts: We believe that a highly leveraged balance sheet can be troubling for Altra Industrial. Exiting the first quarter of 2019, the company's long-term debt was $1,676.6 million while its interest expenses in the quarter totaled $19.8 million versus $1.8 million in the year-ago quarter. We believe that rising debt, if unchecked, will increase its financial obligations and might prove detrimental to its profitability in the future.

It is worth noting here that the company's long-term debt increased 73.1% (CAGR) in three years (2016-2018). Also, the company’s debt/capital of roughly 48% is higher than the industry’s 44%.

Weakness in Certain End-Markets: Altra Industrial serves customers in various end-markets, including general industrial, water infrastructure, construction, wind, mining and aerospace. Weakness in one or more of these markets can be concerning for the company.

For instance, business in the energy markets, including oil & gas, were weak for the company in the first quarter of 2019. Also, specialty machinery and factory automation as well as distribution were weak in the quarter.

The company believes that business in the trucking market of the United States will lose momentum exiting 2019.

Stocks to Consider

Some better-ranked stocks in the industry are Roper Technologies, Inc. ROP, Chart Industries, Inc. GTLS and RBC Bearings Incorporated ROLL. While Roper currently sports a Zacks Rank #1 (Strong Buy), both Chart Industries and RBC Bearings carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for all three stocks have improved for the current year. Further, average earnings surprise for the last four quarters was 8.43% for Roper, 16.56% for Chart Industries and 8.36% for RBC Bearings.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

RBC Bearings Incorporated (ROLL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance