Here's Why Hold Strategy is Apt for Graco (GGG) Stock Now

Graco Inc. GGG has been benefiting from product innovations and sound liquidity positions despite weakness in the Industrial segment and increasing costs.

Let’s discuss the factors that should cause investors to retain the stock for the time being.

Growth Catalysts

Product Innovation: Graco remains focused on launching new products and upgrading the existing ones according to the industry trend. Regarding innovation, over the past year, the company introduced InvisiPac HM10, a hot melt adhesive dispense system, an electric-powered airless gun and Ultra QuickShot. It also introduced the ES 500 Stencil rig, LineLazer ES 500 electric battery-powered airless striper, Contractor King air-powered protective coatings sprayer and Silver Plus HP spray guns.

In the first quarter of 2024 and full year 2023, it spent $21.9 million and $83 million, respectively, for product developments. Despite the slow start to the year, the company expects improving order rates, coupled with product introductions to drive its performance in the upcoming quarters. Graco expects its new products, particularly in the Contractor segment, to provide incremental sales in 2024compared with the previous year.

Investments in Manufacturing Facilities: Graco remains committed to making investments to boost growth. For instance, in 2023, the company expanded its South Dakota manufacturing facility and built a new manufacturing facility in Sibiu, Romania. In addition, it invested in the construction of a new facility in St. Gallen, Switzerland, that will oversee the manufacturing operations for its powder division. This apart, the company started the expansion of its Minnesota facility. These projects signify the significant investment in the expansion and modernization of Graco’s key manufacturing and distribution facilities.

Rewards to Shareholders: Graco’s shareholder-friendly policies are encouraging. In the first three months of 2024, it paid out dividends worth $42.9 million to its shareholders, reflecting an increase of 8.9% year over year. Also, the company remunerated its shareholders with dividends of $158.3 million in 2023, up 11.4% year over year. It repurchased shares worth $102.3 million in 2023. In December 2023, the company hiked its quarterly dividend by 8.5% to 25.5 cents per share.

In light of the above-mentioned positives, we believe investors should retain GGG stock for now, as suggested by its Zacks Rank #3 (Hold).

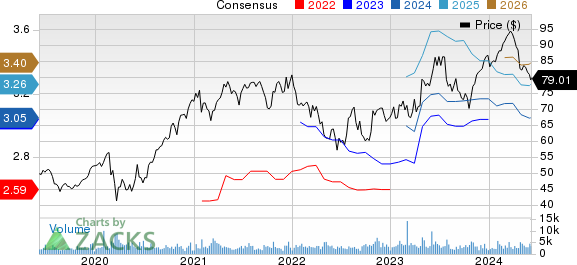

Graco Inc. Price and Consensus

Graco Inc. price-consensus-chart | Graco Inc. Quote

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below.

Applied Industrial Technologies, Inc. AIT presently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 8.2%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for AIT’s fiscal 2024 earnings has improved 1.4% in the past 60 days. The stock has risen 40.3% in the past year.

Belden Inc. BDC presently carries a Zacks Rank of 2 and has a trailing four-quarter earnings surprise of 14.7%, on average.

The consensus estimate for BDC’s 2024 earnings has increased 8.3% in the past 60 days. Shares of Belden have gained 3.5% in the past year.

Crane Company CR presently carries a Zacks Rank of 2. CR delivered a trailing four-quarter earnings surprise of 15.2%, on average.

The Zacks Consensus Estimate for CR’s 2024 earnings has increased 4% in the past 60 days. Its shares have gained 83.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Belden Inc (BDC) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance