Here's Why You Should Hold Crane Holdings (CR) Stock for Now

Crane Holdings Co. CR is well-poised to gain from its diverse end markets, including general industrial, chemical and pharmaceutical markets despite pandemic impacts, inflationary pressures and supply-chain issues. Also, CR’s improving order trends, investment in technology, efforts to develop products and focus on commercial excellence will likely boost its performance in the quarters ahead.

CR’s Payment & Merchandising Technologies segment will likely benefit from strength across crane-payment innovations. Its robust commercial aerospace and commercial aftermarket businesses are anticipated to boost the Aerospace & Electronics segment. The Engineered Materials segment is expected to do well on broad-based strength across the end markets, including RV and building materials.

Crane Holdings divested Redco Corporation in August 2022. This divestment allows CR to focus more on its core business areas. Also, by removing all asbestos-related liabilities and obligations from CR’s balance sheet, the transaction will increase its annual free cash flow, aiding in long-term value creation for its stakeholders.

CR’s measures to reward its shareholders through dividend payments and share buybacks are noteworthy. In the first nine months of 2022, Crane Holdings paid out dividends worth $79.5 million and repurchased shares of $203.7 million. The board also announced a 9% hike in its quarterly dividend rate in January 2022.

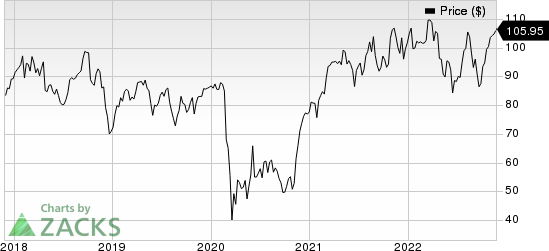

Crane Holdings, Co. Price

Crane Holdings, Co. price | Crane Holdings, Co. Quote

Considering the above-mentioned tailwinds, we believe, investors should retain Crane Holdings’ stock for now, as is suggested by its current Zacks Rank #3 (Hold).

Key Picks

Some better-ranked companies from the Industrial Products sector are discussed below:

Enerpac Tool Group Corp. EPAC delivered an average four-quarter earnings surprise of 3.4%. EPAC presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

EPAC’s earnings estimates have increased 9.1% for fiscal 2023 (ending August 2023) in the past 60 days. The stock has gained 22.6% in the past six months.

Applied Industrial Technologies, Inc. AIT presently has a Zacks Rank of 1 and a trailing four-quarter earnings surprise of 24.8%, on average.

AIT’s earnings estimates have increased 3% for fiscal 2023 (ending June 2023) in the past 60 days. Shares of Applied Industrial have risen 29.2% in the past six months.

IDEX Corporation IEX presently has a Zacks Rank #2 (Buy). IEX’s earnings surprise in the last four quarters was 5.7%, on average.

In the past 60 days, IDEX’s earnings estimates have increased 1.8% for 2022. The stock has rallied 24.5% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Crane Holdings, Co. (CR) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance