Here's Why British Land (LON:BLND) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like British Land (LON:BLND). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for British Land

British Land's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. It's an outstanding feat for British Land to have grown EPS from UK£0.074 to UK£0.60 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of British Land's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that British Land is growing revenues, and EBIT margins improved by 14.6 percentage points to 65%, over the last year. That's great to see, on both counts.

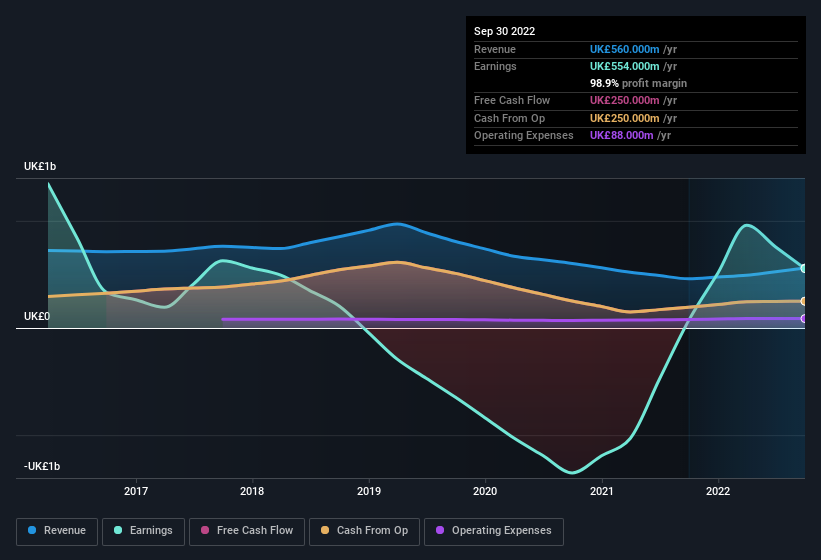

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of British Land's forecast profits?

Are British Land Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that British Land insiders spent UK£106k on stock, over the last year; in contrast, we didn't see any selling. This is a good look for the company as it paints an optimistic picture for the future. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Chairman of the Board Tim Score for UK£25k worth of shares, at about UK£4.50 per share.

Should You Add British Land To Your Watchlist?

British Land's earnings per share have been soaring, with growth rates sky high. Growth-minded people will be intrigued by the incredible movement in EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this is the case, then keeping a watch over British Land could be in your best interest. Even so, be aware that British Land is showing 1 warning sign in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of British Land, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance