Here's Why Australian Agricultural Projects (ASX:AAP) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Australian Agricultural Projects (ASX:AAP), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Australian Agricultural Projects

How Fast Is Australian Agricultural Projects Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Commendations have to be given in seeing that Australian Agricultural Projects grew its EPS from AU$0.000079 to AU$0.0004, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

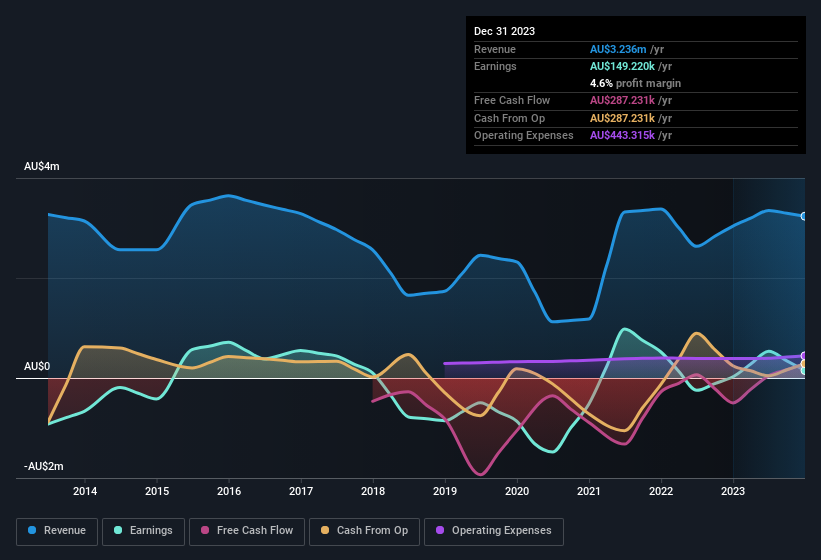

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Australian Agricultural Projects remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 6.5% to AU$3.2m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Australian Agricultural Projects is no giant, with a market capitalisation of AU$7.7m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Australian Agricultural Projects Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Australian Agricultural Projects insiders spent AU$177k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. It is also worth noting that it was MD & Executive Director Paul Challis who made the biggest single purchase, worth AU$50k, paying AU$0.01 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Australian Agricultural Projects insiders own more than a third of the company. Indeed, with a collective holding of 52%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Valued at only AU$7.7m Australian Agricultural Projects is really small for a listed company. So despite a large proportional holding, insiders only have AU$4.0m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Paul Challis, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Australian Agricultural Projects with market caps under AU$302m is about AU$450k.

The CEO of Australian Agricultural Projects only received AU$158k in total compensation for the year ending June 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Australian Agricultural Projects Worth Keeping An Eye On?

Australian Agricultural Projects' earnings per share growth have been climbing higher at an appreciable rate. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Australian Agricultural Projects deserves timely attention. You should always think about risks though. Case in point, we've spotted 5 warning signs for Australian Agricultural Projects you should be aware of, and 2 of them shouldn't be ignored.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Australian Agricultural Projects, you'll probably love this curated collection of companies in AU that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance