Here's How Spectrum Brands (SPB) is Poised Ahead of Q2 Earnings

Spectrum Brands Holdings, Inc. SPB is expected to register bottom-line growth when it reports second-quarter fiscal 2024 results on May 9, before the opening bell.

The Zacks Consensus Estimate for the fiscal quarter’s bottom line is pegged at 49 cents per share, which compares favorably with the loss of 14 cents per share reported in the year-ago quarter. The consensus mark has remained unchanged in the past 30 days. The consensus mark for revenues is pegged at $708.2 million, indicating a decline of 2.9% from the figure reported in the year-ago quarter.

In the last reported quarter, the company delivered an earnings surprise of 151.6%. It recorded an earnings surprise of 60.4%, on average, in the trailing four quarters.

Factors to Note

Spectrum Brands has been benefiting from increased pricing, cost improvements and a favorable mix. Gains from these actions have been aiding the company’s margins. Lower distribution costs, fixed-cost-reduction initiatives and positive pricing impacts are expected to have boosted the EBITDA margin and the bottom line.

Spectrum Brands has been progressing well with the Global Productivity Improvement Plan and strategic transformation plans. The Global Productivity Improvement Plan has been aiming to improve the company's operating efficiency and effectiveness, while focusing on consumer insights and growth-enabling functions, including technology, marketing, and research and development. The majority of savings are expected to be reinvested into growth initiatives and consumer insights, R&D and marketing across each of the businesses. This is likely to have aided the company’s fiscal second-quarter performance.

SPB has been streamlining its organizational structure and re-energizing its employee base. It has been committed to improving operational efficiencies throughout and limiting risk. The company has been focused on transforming into a pure-play global Pet and Home & Garden business.

However, Spectrum Brands has been witnessing soft demand in the North American small kitchen appliances category, volume declines in certain pet channels and the impact of SKU rationalization decisions made in fiscal 2023 within the Global Pet Care and Home & Personal Care (HPC) businesses. This, along with a tough consumer environment, is likely to have been a concern. On the last reported quarter’s earnings call, management had anticipated the demand pressure in the HPC business segment to be more pronounced in the first half of fiscal 2024.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Spectrum Brands this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

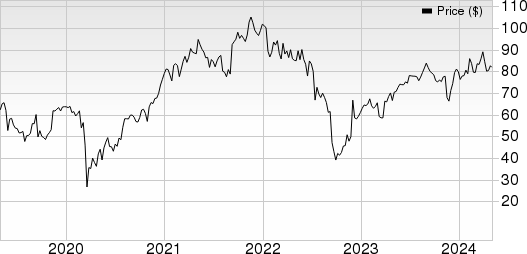

Spectrum Brands Holdings Inc. Price and EPS Surprise

Spectrum Brands Holdings Inc. price-eps-surprise | Spectrum Brands Holdings Inc. Quote

Spectrum Brands has an Earnings ESP of 0.00% and a Zacks Rank of 3.

Stocks Poised to Beat Earnings Estimates

Here are some companies, which, according to our model, have the right combination of elements to post an earnings beat:

Central Garden & Pet CENT currently has an Earnings ESP of +4.32% and a Zacks Rank of 1. CENT is likely to register bottom-line growth when it reports second-quarter fiscal 2024 results. The Zacks Consensus Estimate for CENT’s earnings is pegged at 83 cents a share, up 15.3% from the year-ago quarter. The consensus mark has risen a couple of cents in the past 30 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for its revenues is pegged at $894.5 million, suggesting a 1.6% drop from the figure reported in the prior-year quarter.

Planet Fitness PLNT currently has an Earnings ESP of +1.69% and a Zacks Rank of 3. PLNT is likely to register top and bottom-line growth when it reports first-quarter 2024 results. The Zacks Consensus Estimate for its revenues is pegged at $249.4 million, suggesting 12.2% growth from the figure reported in the prior-year quarter.

The consensus estimate for Planet Fitness’ earnings is pegged at 49 cents per share, suggesting 19.5% growth from the year-ago quarter. The consensus mark has moved down a penny in the past 30 days.

Electronic Arts EA currently has an Earnings ESP of +1.03% and a Zacks Rank of 3. NKE is likely to register a top and bottom-line decline when it reports fourth-quarter fiscal 2024 results. The Zacks Consensus Estimate for its revenues is pegged at $1.8 billion, suggesting a 7.7% drop from the figure reported in the prior-year quarter.

The consensus estimate for EA’s fourth-quarter earnings is pegged at $1.56 per share, suggesting an 11.9% decline from the year-ago quarter. The consensus mark has remained unchanged in the past 30 days.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.`

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Central Garden & Pet Company (CENT) : Free Stock Analysis Report

Electronic Arts Inc. (EA) : Free Stock Analysis Report

Spectrum Brands Holdings Inc. (SPB) : Free Stock Analysis Report

Planet Fitness, Inc. (PLNT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance