Heavy Machinery Stocks Q1 Teardown: Greenbrier (NYSE:GBX) Vs The Rest

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how heavy machinery stocks fared in Q1, starting with Greenbrier (NYSE:GBX).

Automation that increases efficiencies and connected equipment that collects analyzable data have been trending, creating new demand for heavy machinery and equipment companies. The gradual transition to clean energy also allows companies to innovate around emissions, potentially spurring replacement cycles that can accelerate revenue growth. On the other hand, heavy machinery companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the commercial and residential construction that drives demand for these companies’ offerings.

The 8 heavy machinery stocks we track reported a strong Q1; on average, revenues beat analyst consensus estimates by 1.1%. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the heavy machinery stocks have fared somewhat better than others, they collectively declined, with share prices falling 0.6% on average since the previous earnings results.

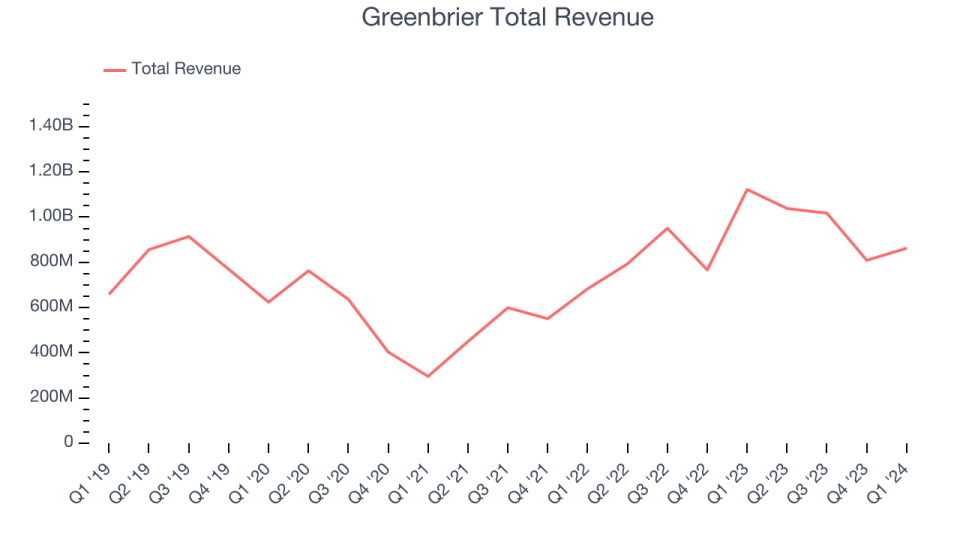

Greenbrier (NYSE:GBX)

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE:GBX) supplies the freight rail transportation industry with railcars and related services.

Greenbrier reported revenues of $862.7 million, down 23.1% year on year, topping analysts' expectations by 2.5%. It was a very strong quarter for the company, with an impressive beat of analysts' volume estimates and a solid beat of analysts' earnings estimates.

Greenbrier delivered the slowest revenue growth of the whole group. The stock is down 1.8% since the results and currently trades at $51.42.

Is now the time to buy Greenbrier? Access our full analysis of the earnings results here, it's free.

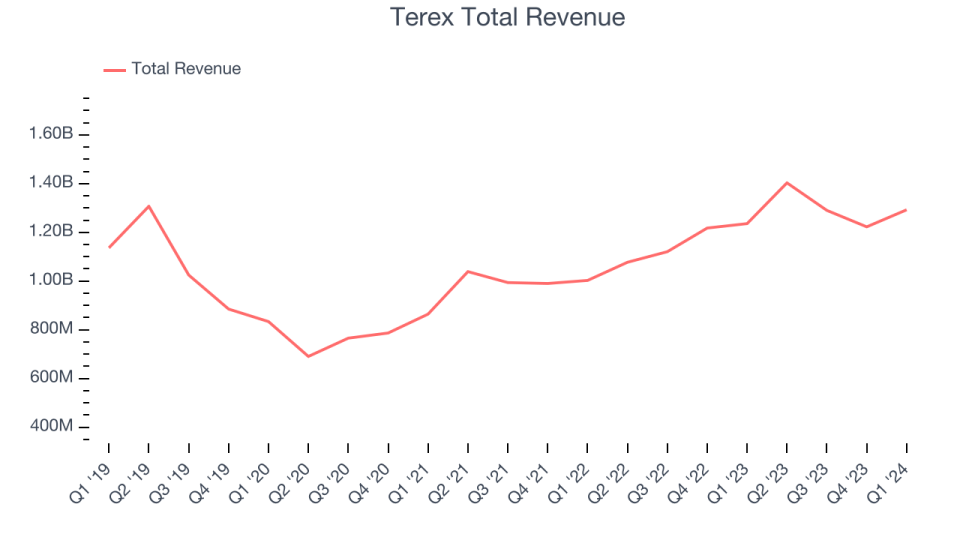

Best Q1: Terex (NYSE:TEX)

With humble beginnings as a dump truck company, Terex (NYSE:TEX) today manufactures lifting and material handling equipment designed to move and hoist heavy goods and materials.

Terex reported revenues of $1.29 billion, up 4.6% year on year, outperforming analysts' expectations by 5%. It was a stunning quarter for the company, with an impressive beat of analysts' organic revenue estimates.

The stock is down 4.7% since the results and currently trades at $57.05.

Is now the time to buy Terex? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Lindsay (NYSE:LNN)

A pioneer in the field of center pivot and lateral move irrigation, Lindsay (NYSE:LNN) provides a variety of proprietary water management and road infrastructure products and services.

Lindsay reported revenues of $151.5 million, down 8.9% year on year, falling short of analysts' expectations by 12.3%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

Lindsay had the weakest performance against analyst estimates in the group. The stock is down 0.8% since the results and currently trades at $114.3.

Read our full analysis of Lindsay's results here.

PACCAR (NASDAQ:PCAR)

Founded more than a century ago, PACCAR (NASDAQ:PCAC) designs and manufactures commercial trucks of various weights and sizes for the commercial trucking industry.

PACCAR reported revenues of $8.24 billion, up 2.3% year on year, in line with analysts' expectations. It was a strong quarter for the company, with an impressive beat of analysts' organic revenue estimates and a solid beat of analysts' operating margin estimates.

The stock is down 4% since the results and currently trades at $109.07.

Read our full, actionable report on PACCAR here, it's free.

Wabtec (NYSE:WAB)

Also known as Wabtec, Westinghouse Air Brake Technologies (NYSE:WAB) provides equipment, systems, and its related software for the railway industry.

Wabtec reported revenues of $2.50 billion, up 13.8% year on year, surpassing analysts' expectations by 4.4%. It was an exceptional quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 10.6% since the results and currently trades at $164.18.

Read our full, actionable report on Wabtec here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance