Will Healthy Top-Line Growth Aid Verizon (VZ) Q3 Earnings?

Verizon Communications Inc. VZ is scheduled to report third-quarter 2021 results on Oct 20, before the opening bell. In the last reported quarter, the New York-based telecom and media giant beat the Zacks Consensus Estimate by 7 cents. The company is expected to have recorded higher aggregate revenues year over year driven by a healthy momentum in its wireless business.

Factors at Play

During the third quarter, Verizon continued the aggressive rollout of 5G Ultra Wideband service to expand its coverage to 82 cities across the country. The company also deployed Home Internet service in select cities, where users experience a maximum download speed of up to 1 Gbps, to bring its coverage to 57 markets. It further expanded its 5G Business Internet service that offers an alternative to cable broadband to 54 cities. The diversified offerings for different user groups are expected to get reflected in the third-quarter results.

In the quarter, Verizon secured a prime contract from the U.S. Department of Defense to provide 5G mobility service to seven Air Force Reserve Command installations. Verizon Public sector, the unit dedicated to serving various public sector entities, has been entrusted to deliver 5G Ultra Wideband service in California, Florida, Massachusetts, New York, Ohio, Pennsylvania, and Texas Air Force bases. This includes the deployment of c-band radios at outdoor locations at the facilities to improve signal bandwidth at higher speed and lower latency. These are expected to have driven the company’s top-line growth.

During the quarter, Verizon upgraded some of the features of its subsidiary BlueJeans that offers an interoperable cloud-based video conferencing service across a wide range of devices and conferencing platforms. The move is aimed to facilitate a seamless transition to a hybrid workplace with a spontaneous and engaging interactive digital platform as the work-from-home option continues to gain traction. Technological innovations are likely to provide flexibility to remote workers and unlock workplace productivity and happiness. Such initiatives are likely to have led to top-line growth in the third quarter.

During the third quarter, Verizon partnered with Mastercard to develop solutions that will transform the global payments industry. The solutions will enable smartphones or other connected devices to seamlessly accept payment and unlock touchless retail shopping experiences. It will also create new ways to consume physical and digital goods and deliver digital capabilities for small and medium businesses.

In addition, Verizon formed a new business unit — Robotics Business Technology — to develop enterprise-grade solutions for aerial and ground robotics. The unit will provide comprehensive solutions that leverage Verizon’s 5G and mobile edge compute capabilities. The unit will provide connected robotics solutions to customers for indoor and outdoor use cases in manufacturing, construction, logistics and utilities, among others. These efforts are likely to have improved its revenues in the to-be-reported quarter.

The Zacks Consensus Estimate for total revenues for the company stands at $33,411 million. It generated revenues of $31,543 million in the prior-year quarter. The consensus mark for earnings is currently pegged at $1.36 per share, indicating a healthy improvement from $1.25 reported in the year-earlier quarter.

Key Developments in Q3

During the quarter, Verizon amicably settled two patent lawsuits with telecommunication equipment manufacturer Huawei Technologies in an out-of-court settlement, the details of which were kept under wraps. The legal resolution puts to rest the uncertainty embroiled with the court proceedings and both the companies were reportedly pleased with the settlement, despite maintaining the secrecy of the due process involved. Verizon is likely to benefit from the eventualities to better focus on its 5G roadmap in the country.

Earnings Whispers

Our proven model predicts an earnings beat for Verizon this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is perfectly the case here.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is +0.28%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

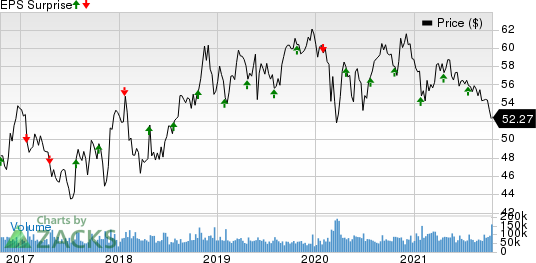

Verizon Communications Inc. Price and EPS Surprise

Verizon Communications Inc. price-eps-surprise | Verizon Communications Inc. Quote

Zacks Rank: Verizon currently has a Zacks Rank #3.

Other Stocks to Consider

Here are some other companies you may want to consider, as our model shows that these too have the right combination of elements to post an earnings beat this season:

Qualcomm Incorporated QCOM is set to release quarterly numbers on Nov 3. It has an Earnings ESP of +0.35% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Earnings ESP for AT&T Inc. T is +1.11% and it carries a Zacks Rank of 3. The company is set to report quarterly numbers on Oct 21.

The Earnings ESP for T-Mobile US Inc. TMUS is +18.33% and it carries a Zacks Rank of 3. The company is scheduled to report quarterly numbers on Nov 4.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

AT&T Inc. (T) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

TMobile US, Inc. (TMUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance