HCA Healthcare Inc. (HCA) Surpasses Analyst Revenue Forecasts with Strong Q1 2024 Performance

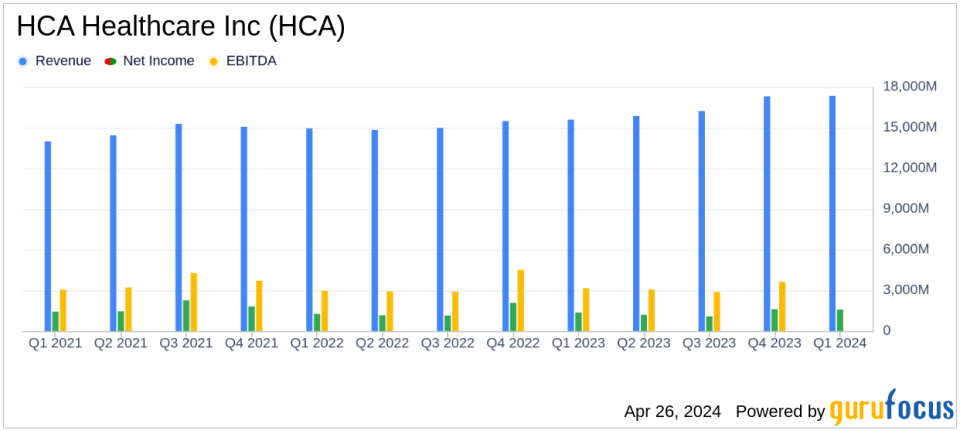

Revenue: Reported $17.339 billion for Q1 2024, up 11.2% from $15.591 billion in Q1 2023, surpassing the estimate of $16.779 billion.

Net Income: Achieved $1.591 billion, a 16.7% increase from $1.363 billion in the previous year, exceeding the estimated $1.362 billion.

Earnings Per Share (EPS): Recorded $5.93 per diluted share, significantly higher than the $4.85 from Q1 2023 and surpassing the estimated $5.01.

Adjusted EBITDA: Totaled $3.353 billion, up from $3.172 billion year-over-year, indicating strong profitability and operational efficiency.

Operating Cash Flow: Cash flows from operations rose to $2.469 billion, up from $1.803 billion in the prior year, reflecting improved operational efficiency.

Capital Expenditures: Capital spending reached $1.118 billion, excluding acquisitions, underscoring ongoing investment in facilities and equipment.

Stock Repurchase: Repurchased 3.894 million shares for $1.180 billion, demonstrating confidence in the company's financial health and future prospects.

HCA Healthcare Inc (NYSE:HCA) released its 8-K filing on April 26, 2024, revealing a significant surpass in revenue expectations for the first quarter of 2024. The Nashville-based healthcare giant reported a revenue of $17.339 billion, exceeding the analyst's estimate of $16.779 billion. This marks a substantial increase from the $15.591 billion recorded in the same quarter of the previous year. Net income also saw a notable rise to $1.591 billion, or $5.93 per diluted share, compared to $1.363 billion, or $4.85 per diluted share in Q1 2023.

HCA Healthcare operates as the largest collection of acute-care hospitals in the United States, with a significant presence in 20 states and a small footprint in England. As of March 31, 2024, the company managed 188 hospitals and approximately 2,400 ambulatory sites of care, including surgery centers and urgent care clinics.

Operational Highlights and Financial Metrics

The first quarter results were buoyed by a 6.2% increase in same-facility admissions and a 5.2% rise in same-facility equivalent admissions. Emergency room visits also grew by 7.2%, reflecting a robust demand for HCA's healthcare services. Despite these increases, same facility outpatient surgeries saw a slight decline of 2.1%. The company's revenue per equivalent admission increased by 3.5% year-over-year.

On the financial side, HCA Healthcare demonstrated strong cash flow generation with $2.469 billion in cash flows from operating activities, up from $1.803 billion in the prior year's quarter. The balance sheet as of March 31, 2024, showed $1.284 billion in cash and cash equivalents, with total debt standing at $40.191 billion.

Strategic Moves and Shareholder Returns

In Q1 2024, HCA Healthcare made significant capital expenditures totaling $1.118 billion, excluding acquisitions, aimed at expanding and improving its facilities. The company also returned value to shareholders by repurchasing 3.894 million shares for $1.180 billion and declared a quarterly dividend of $0.66 per share, payable on June 28, 2024.

Forward Guidance and Market Outlook

HCA Healthcare reaffirmed its 2024 guidance, anticipating continued growth based on volume increases and operational efficiency. The guidance reflects the company's expectations regarding patient volumes, payer mix, and economic conditions, including inflation.

The company's performance in the first quarter of 2024 sets a positive tone for the year, with strategic investments and operational improvements likely to bolster its market position further. HCA's focus on expanding its service offerings and enhancing operational efficiencies, combined with a strong financial position, positions it well for sustainable growth in the competitive healthcare market.

Conclusion

HCA Healthcare's Q1 2024 results not only surpassed revenue expectations but also showcased a strategic acumen in managing expenses and investing in growth opportunities. With a robust healthcare network and a focus on operational excellence, HCA continues to be a formidable player in the healthcare industry, promising value for its stakeholders and patients alike.

Explore the complete 8-K earnings release (here) from HCA Healthcare Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance