$35 a pack: Has Australia’s tobacco tax worked?

Cigarettes in Australia have hit more than $35 for a pack of 20 after successive tobacco tax hikes, and now new research has found that price increases since 2010 have led to decreases in smoking.

Related story: Cancer Council pushes to stop thousands of businesses selling tobacco

Related story: $100 cigarettes, $81 beer: How much everyday items will cost in 2030

The Cancer Council Victoria-funded study found that the 25 per cent tax increase on 30 April 2010 saw an immediate 0.74 percentage point reduction in the prevalence of smoking and an overall fall of 4.2 per cent.

Between April 2010 and April 2017, smoking declined in Australians 14 and over from 17.87 per cent to 13.30 per cent - or a fall of around 890,000 Australians, Cancer Council data provided to Yahoo Finance revealed. That figure represents a quarter of the current smoking population in Australia.

In the months after the April 2010 25 per cent hike, around 135,000 people stopped smoking, while another 185,000 dropped off following the first of the pre-announced 12.5 per cent tax increases implemented from December 2013.

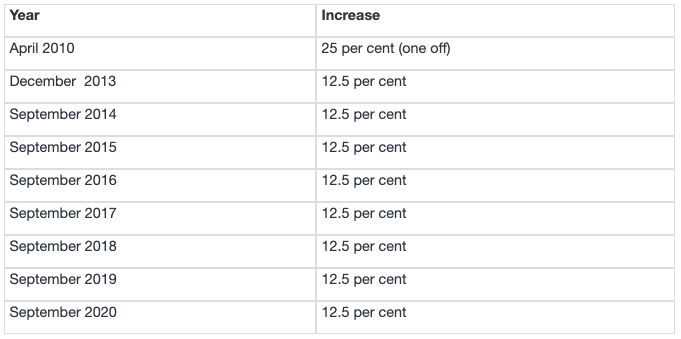

This is the tobacco excise increase schedule:

The tax hikes are expected to bring the government $4.7 billion between 2016 and the final hike.

These smaller hikes were also considered more equitable for lower socio-economic status Australians.

The September 2019 12.5 per cent hike brought the average price for a packet of cigarettes in Australia to $35, the most expensive in the world.

Recommended retail price of Australia’s most popular cigarettes

“Tobacco tax increases have an important effect on reducing smoking prevalence, and this study has significant implications for guiding tobacco policy in other countries,” Cancer Council Victoria CEO Todd Harper said.

“Over the period of the study in Australia, we saw tobacco companies bringing out smaller pouch sizes – even ‘kiddy’ pouches as small as 15 grams of tobacco. We also saw companies adding ‘bonus’ sticks into cigarette packs to tempt consumers to keep buying.

“We would like to see standardisation of cigarette packs to 20 sticks and pouch sizes to 30 grams, as well as use of minimum prices, to reduce the ability of tobacco companies to market cheaper products and thus lessen the impact of tobacco tax.”

The tax increases saw prices speed ahead of inflation

The tax increases also saw people move to roll-your-own tobacco products as they initially weren’t taxed at the same rate, with Dr Michelle Scollo from the Cancer Council Victoria noting the drop in smoking would likely have been higher if these products were included in the hikes.

“To maximise the effectiveness of increases in tobacco taxes and to reduce product switching, tobacco product taxes should be equivalent for ready-made and roll-your own tobacco. We also recommend letting the public know ahead of the implementation of any large tax increase,” Scollo said.

“This is especially important from an equity perspective to provide the best chance of quitting completely for smokers from all backgrounds.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance