Harley-Davidson Q1 Earnings: Mixed Results Amidst Strategic Adjustments

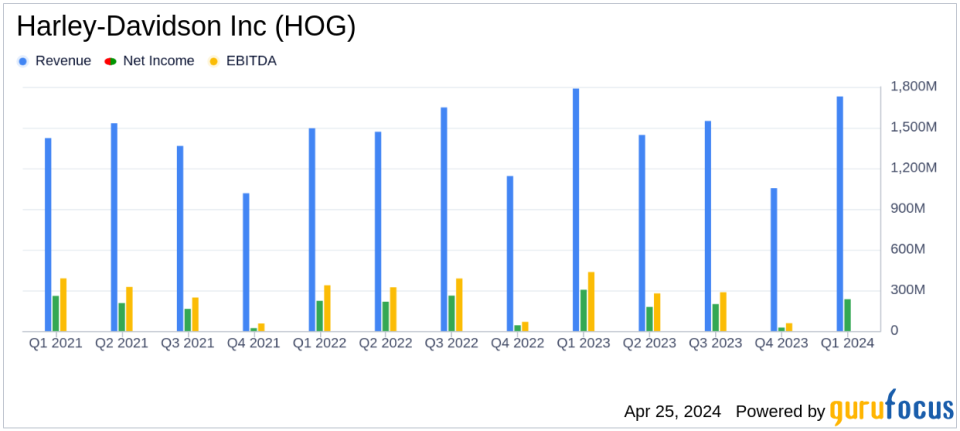

Diluted EPS: Reported at $1.72, down 16% year-over-year, surpassing the estimated $1.51.

Revenue: Totaled $1.73 billion, a decrease of 3% from the previous year, exceeding the estimated $1.34 billion.

Net Income: Recorded at $235 million, a 23% decrease from the previous year, surpassing the estimated $213.49 million.

Operating Income Margin: Declined to 15% from 21% in the previous year, reflecting lower profitability.

North America Motorcycle Retail Sales: Increased by 6%, driven by new Touring motorcycles.

Share Repurchase: Repurchased $98 million worth of shares (2.5 million shares) during the quarter.

Full-Year Financial Outlook: Reaffirmed with expected HDMC revenue to be flat to down 9% and operating income margin between 12.6% to 13.6%.

On April 25, 2024, Harley-Davidson Inc (NYSE:HOG) disclosed its first-quarter financial outcomes through an 8-K filing, revealing a complex landscape of growth, challenges, and strategic pivots. The renowned motorcycle manufacturer, known for its heavyweight motorcycles and comprehensive financial services, reported a diluted EPS of $1.72, surpassing the analyst estimate of $1.51. However, the company's revenue saw a decline, reporting $1,730 million against the expected $1,339.53 million, indicating a mixed financial performance in a transformative phase.

Company Overview

Harley-Davidson stands as a pivotal entity in the heavyweight motorcycle sector, offering a diverse range of motorcycles, parts, accessories, and financial services. The company has been navigating through market shifts with initiatives like the expansion into electric vehicles through its LiveWire brand and enhancing its core touring models, which remain central to its product strategy.

Financial Performance Insights

The first quarter of 2024 saw Harley-Davidson grappling with several financial headwinds. The company's overall revenue dipped by 3% year-over-year, primarily due to a 5% decline in HDMC (Harley-Davidson Motor Company) revenues, which was somewhat offset by a 12% increase in revenues from Harley-Davidson Financial Services (HDFS). The operating income plummeted by 29%, with significant declines noted across both HDMC and HDFS segments.

Operational Highlights and Challenges

Harley-Davidson's operational strategy this quarter reflected a deliberate reduction in motorcycle shipments, aligning with its broader strategic adjustments. This resulted in a 7% decrease in global motorcycle shipments. Despite these reductions, North America, Harley-Davidson's largest market, experienced a 6% growth in retail sales, driven by strong demand for its new touring motorcycles. However, international markets faced challenges, with notable sales declines in EMEA and Asia Pacific regions due to delayed shipments and weak performance in key markets like Germany, France, and China.

Strategic Developments and Financial Health

The quarter also highlighted Harley-Davidson's strategic strides in the electric vehicle market. The LiveWire segment, despite a 39% revenue drop, marked its leadership in the U.S. on-road electric motorcycle space with the launch of the S2 Mulholland model. Financially, Harley-Davidson maintained a robust balance sheet with $1.5 billion in cash and equivalents, alongside active shareholder returns through dividends and share repurchases totaling $98 million.

Outlook and Future Directions

Looking ahead, Harley-Davidson reaffirmed its 2024 guidance with cautious optimism. The company anticipates flat to a 9% drop in HDMC revenue and a stable to 5% increase in HDFS operating income. Notably, the LiveWire segment's operating loss forecast was improved, reflecting ongoing efforts to refine its electric vehicle strategy.

In summary, Harley-Davidson's first quarter of 2024 encapsulates a period of strategic repositioning amidst challenging market conditions. While the company outperformed EPS estimates, revenue contraction and operational challenges underline the critical balancing act between maintaining traditional business strengths and pursuing growth through innovation in electric mobility.

Explore the complete 8-K earnings release (here) from Harley-Davidson Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance