If You Had Bought Vita Life Sciences (ASX:VLS) Stock Five Years Ago, You'd Be Sitting On A 48% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Vita Life Sciences Limited (ASX:VLS), since the last five years saw the share price fall 48%.

Check out our latest analysis for Vita Life Sciences

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

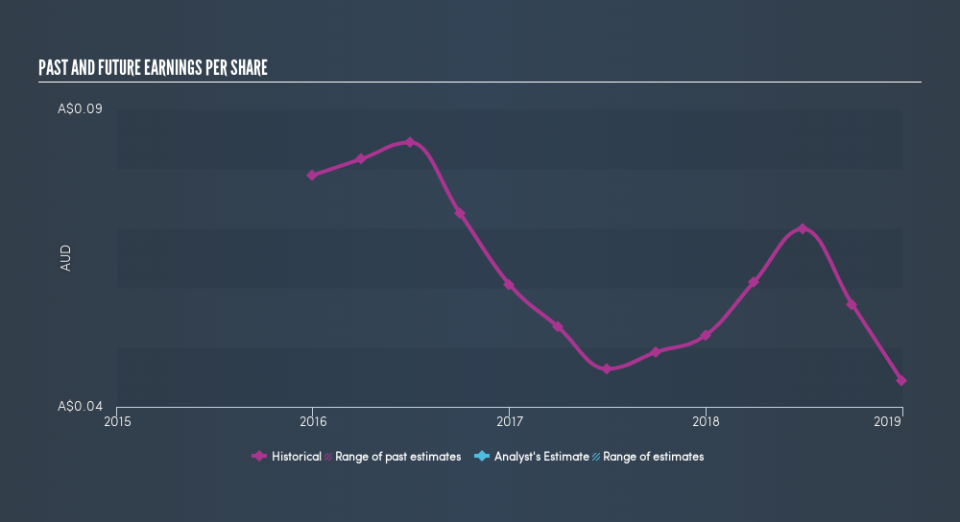

Looking back five years, both Vita Life Sciences's share price and EPS declined; the latter at a rate of 12% per year. This change in EPS is remarkably close to the 12% average annual decrease in the share price. This implies that the market has had a fairly steady view of the stock. Rather, the share price change has reflected changes in earnings per share.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Vita Life Sciences's key metrics by checking this interactive graph of Vita Life Sciences's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Vita Life Sciences's TSR for the last 5 years was -38%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Vita Life Sciences shareholders have received returns of 10% over twelve months (even including dividends), which isn't far from the general market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 9.1%, which was endured over half a decade. While 'turnarounds seldom turn' there are green shoots for Vita Life Sciences. Before forming an opinion on Vita Life Sciences you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

Of course Vita Life Sciences may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance