If You Had Bought Starpharma Holdings (ASX:SPL) Stock Five Years Ago, You Could Pocket A 82% Gain Today

The last three months have been tough on Starpharma Holdings Limited (ASX:SPL) shareholders, who have seen the share price decline a rather worrying 36%. But that doesn't change the fact that the returns over the last five years have been pleasing. After all, the share price is up a market-beating 82% in that time.

View our latest analysis for Starpharma Holdings

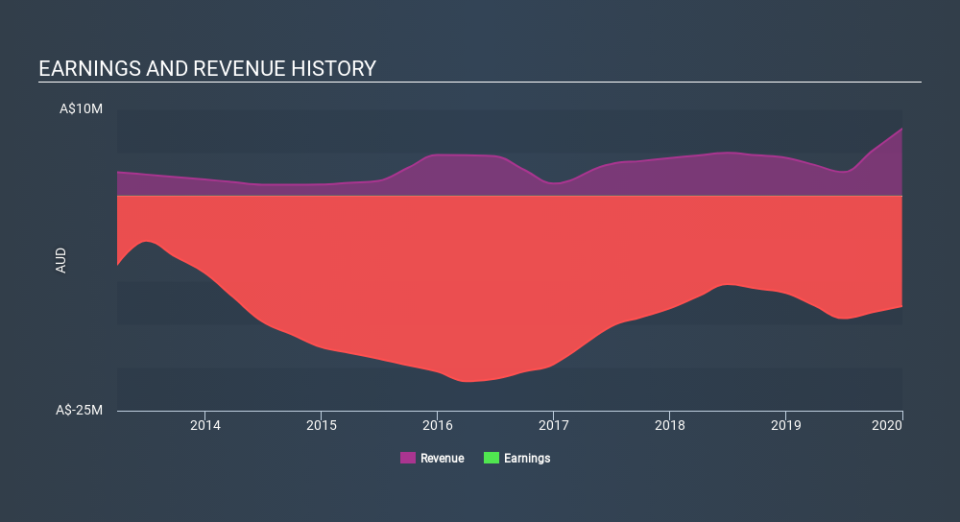

Because Starpharma Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Starpharma Holdings saw its revenue grow at 16% per year. Even measured against other revenue-focussed companies, that's a good result. While the compound gain of 13% per year is good, it's not unreasonable given the strong revenue growth. If you think there could be more growth to come, now might be the time to take a close look at Starpharma Holdings. Opportunity lies where the market hasn't fully priced growth in the underlying business.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Starpharma Holdings's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 12% in the twelve months, Starpharma Holdings shareholders did even worse, losing 20%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 13% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Starpharma Holdings .

Of course Starpharma Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance