If You Had Bought Smartsheet (NYSE:SMAR) Shares A Year Ago You'd Have Made 66%

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. To wit, the Smartsheet Inc. (NYSE:SMAR) share price is 66% higher than it was a year ago, much better than the market return of around 25% (not including dividends) in the same period. So that should have shareholders smiling. Smartsheet hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Smartsheet

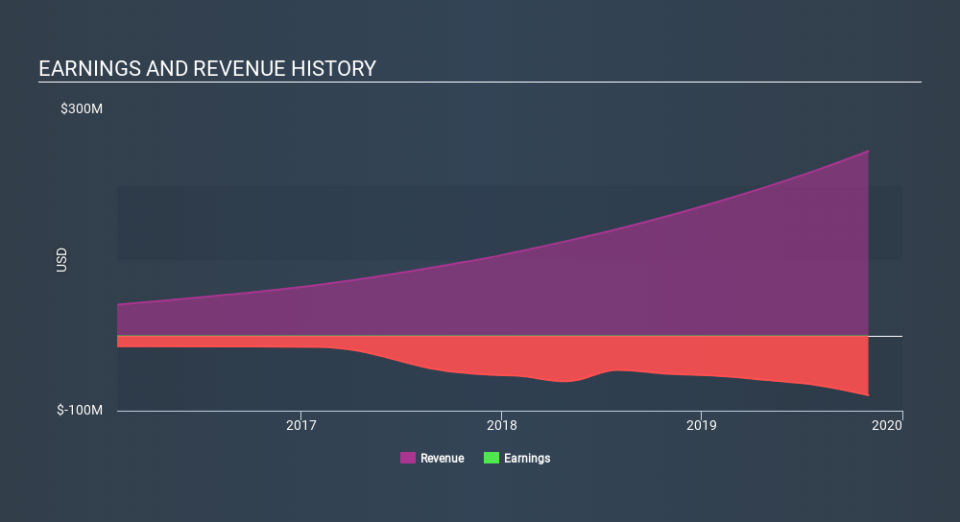

Because Smartsheet made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Smartsheet grew its revenue by 54% last year. That's well above most other pre-profit companies. While the share price gain of 66% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. So quite frankly it could be a good time to investigate Smartsheet in some detail. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Smartsheet in this interactive graph of future profit estimates.

A Different Perspective

Smartsheet boasts a total shareholder return of 66% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 15% in that time. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Smartsheet better, we need to consider many other factors. For instance, we've identified 3 warning signs for Smartsheet (2 are significant) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance