If You Had Bought Ocean Grown Abalone (ASX:OGA) Stock A Year Ago, You'd Be Sitting On A 38% Loss, Today

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Ocean Grown Abalone Limited (ASX:OGA) shareholders over the last year, as the share price declined 38%. That falls noticeably short of the market decline of around 12%. Because Ocean Grown Abalone hasn't been listed for many years, the market is still learning about how the business performs. The falls have accelerated recently, with the share price down 18% in the last three months. But this could be related to the weak market, which is down 24% in the same period.

See our latest analysis for Ocean Grown Abalone

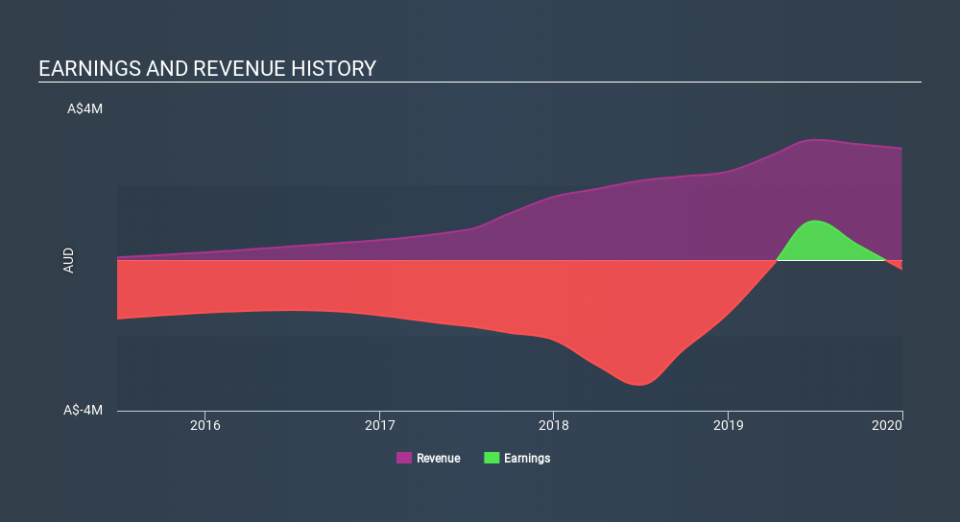

Because Ocean Grown Abalone made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Ocean Grown Abalone increased its revenue by 26%. We think that is pretty nice growth. Meanwhile, the share price is down 38% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Ocean Grown Abalone shareholders are down 37% for the year, even worse than the market loss of 12%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 18% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Ocean Grown Abalone better, we need to consider many other factors. For example, we've discovered 6 warning signs for Ocean Grown Abalone (1 is a bit unpleasant!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance