If You Had Bought Neuren Pharmaceuticals (ASX:NEU) Stock A Year Ago, You Could Pocket A 113% Gain Today

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example Neuren Pharmaceuticals Limited (ASX:NEU). Its share price is already up an impressive 113% in the last twelve months. But it's down 6.8% in the last week. Also impressive, the stock is up 76% over three years, making long term shareholders happy, too.

Check out our latest analysis for Neuren Pharmaceuticals

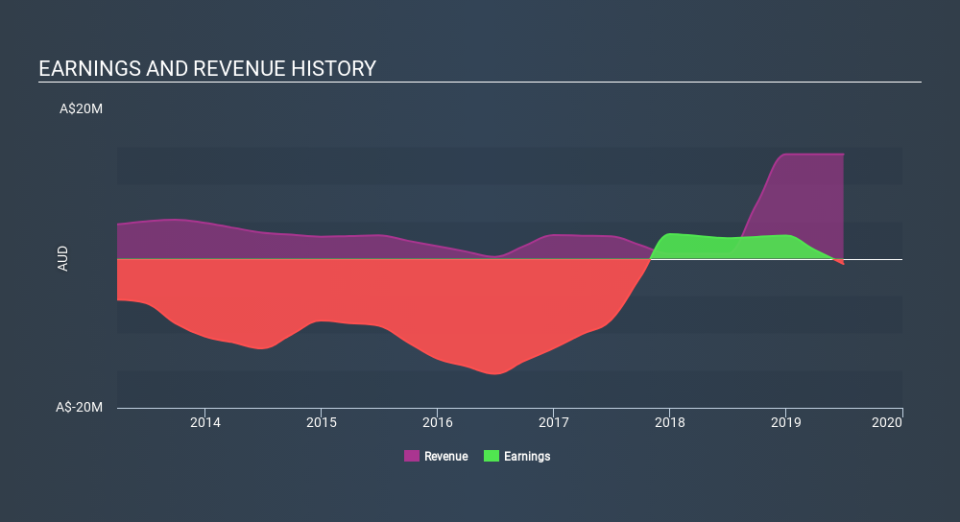

Because Neuren Pharmaceuticals made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Neuren Pharmaceuticals grew its revenue by 2117% last year. That's well above most other pre-profit companies. Meanwhile, the market has paid attention, sending the share price soaring 113% in response. It's great to see strong revenue growth, but the question is whether it can be sustained. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Neuren Pharmaceuticals shareholders have received a total shareholder return of 113% over the last year. Notably the five-year annualised TSR loss of 3.6% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Neuren Pharmaceuticals , and understanding them should be part of your investment process.

We will like Neuren Pharmaceuticals better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance