If You Had Bought MCS Services (ASX:MSG) Stock Five Years Ago, You'd Be Sitting On A 59% Loss, Today

This month, we saw the MCS Services Limited (ASX:MSG) up an impressive 31%. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. In that time the share price has delivered a rude shock to holders, who find themselves down 59% after a long stretch. Some might say the recent bounce is to be expected after such a bad drop. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

See our latest analysis for MCS Services

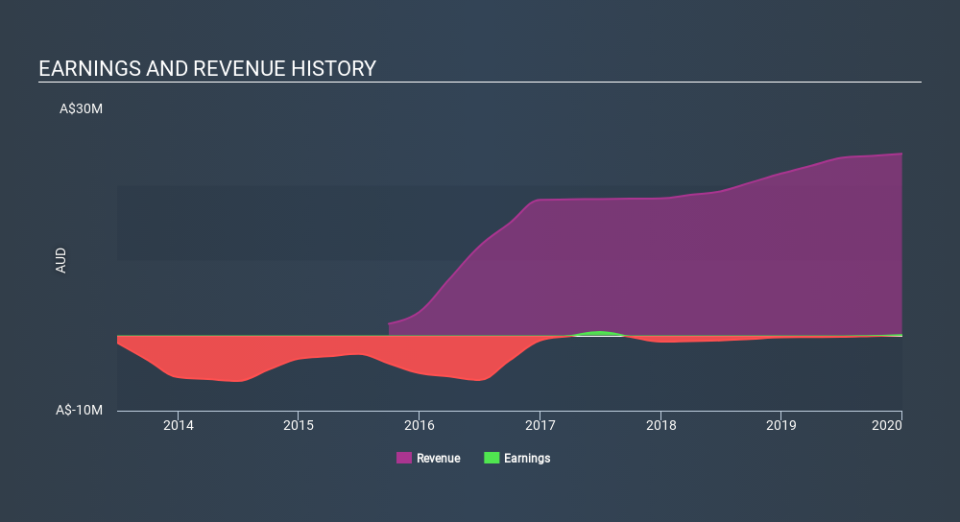

Given that MCS Services only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on MCS Services's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered MCS Services's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. MCS Services's TSR of was a loss of 52% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

It's good to see that MCS Services has rewarded shareholders with a total shareholder return of 6.3% in the last twelve months. Notably the five-year annualised TSR loss of 14% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - MCS Services has 3 warning signs (and 2 which can't be ignored) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance