If You Had Bought Botanix Pharmaceuticals' (ASX:BOT) Shares Three Years Ago You Would Be Down 55%

Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term Botanix Pharmaceuticals Limited (ASX:BOT) shareholders. Regrettably, they have had to cope with a 55% drop in the share price over that period. Furthermore, it's down 35% in about a quarter. That's not much fun for holders.

View our latest analysis for Botanix Pharmaceuticals

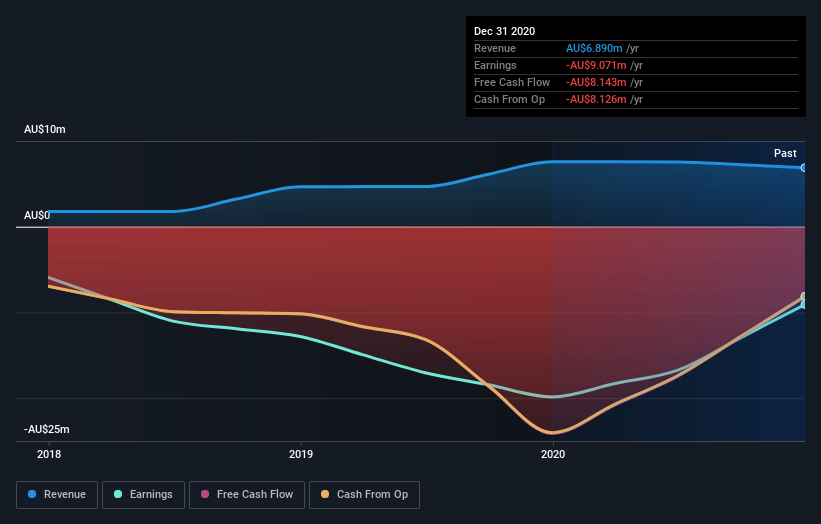

Given that Botanix Pharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Botanix Pharmaceuticals saw its revenue grow by 44% per year, compound. That's well above most other pre-profit companies. The share price has moved in quite the opposite direction, down 16% over that time, a bad result. This could mean hype has come out of the stock because the losses are concerning investors. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Botanix Pharmaceuticals rewarded shareholders with a total shareholder return of 45% over the last year. This recent result is much better than the 16% drop suffered by shareholders each year (on average) over the last three. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. It's always interesting to track share price performance over the longer term. But to understand Botanix Pharmaceuticals better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Botanix Pharmaceuticals (including 1 which makes us a bit uncomfortable) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance