Guest Commentary: Bullish and Long EUR/JPY - The Trailing Trade

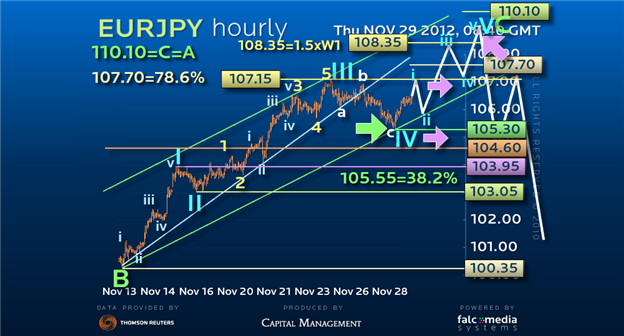

* EUR/JPY has maintained the break of the previous 104.60 high.

* Although this may still form part of broader 94.10-111.45 consolidation, it still has scope to extend in the shorter term.

* Having retraced to the ideal 38.2% corrective target, we have bought.

* However given the threat of medium term consolidation and an eventual reversal, we have now raised stops from 103.95 to 105.30 looking to 'trail' the stop again on further strength.

Euro Yen remains within an uptrend… in the shorter term at least.

Following the break of the 104.60 previous high it has maintained enough momentum not to just to encourage 107.70 the 78.6% triangle target but also with potential for a C=A of 110.10.

Once it has completed a five wave trend sequence from the 100.35 low, can we again look for a reversal?

So having retraced perfectly in other words in a three wave corrective decline just beyond the 105.55 38.2% retracement to 105.30., we have bought for a break up through 107.15 to 107.70 potentially 108.35. In fact the longer it can stay below 107.15 the more bullish it becomes. So provided 105.30 continues to hold once 107.15 is broken we can raise our stops for an aggressive five wave rally all the way to that 110.10 target.

Only then will we sell for a loss of 104.60 to encourage and 103.95 overlap to confirm a reversal.

Further videos or commentaries are available from ww.marketvisiontv.com or @EdMatts on Twitter.

Would you like to see more third-party contributors on DailyFX? For questions and comments, please send them to research@dailyfx.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance