Growth in the $5 trillion passive investment industry has been a boon for market index providers

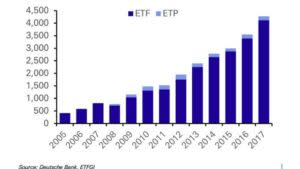

The rise of exchange traded funds (ETFs) has also been a boon for market index providers such as MSCI.

The number of benchmark indices for various asset classes rose by another 12% to 3.73 million in the year to June.

The rise of passive investment vehicles has seen plenty of capital shift away from active money managers towards low-cost index funds.

Over the past decade, assets under management held by the huge global exchange traded funds (ETFs) has almost quintupled:

Along with the huge ETF providers such as Vanguard and BlackRock, there's been another beneficiary -- companies in the global bench-marking business.

The most notable players in the space include MSCI, S&P Dow Jones and the FTSE Group.

They establish benchmark indexes for all kinds of different asset classes, which are then tracked by the ETFs of the huge passive investment managers.

Shares in MSCI have risen by 17% this year, even though the value of Vanguard and BlackRock has declined in that time.

In line with the broader trend towards bench-marked indexes outlined in the chart above, shares in MSCI have risen more than 1,100% since 2008.

And that's partly because the number of indices globally rose by another 12% to 3.73 million in the year to June, according to data from the Index Industry Association.

The IIC was set up by the 14 of the largest benchmark operators -- including the three companies listed above -- and has been collating data for the last two years.

And in addition to traditional ETFs which track major stocks indexes or industry sectors, there's a long list of interesting benchmarks on the market.

According to the Financial Times, indexes have been established for everything from African debt derivatives to groups that adhere to Catholic values.

Stock market indices make up the bulk of global benchmarks at just over three million, although that figure declined by 3% in the 12 months to June.

It was a different story for indexes which track fixed income products - they rose by 16%.

The FT reports that bond ETFs have attracted over $US100 billion of investor capital this year, even as the growth rate of ETFs more broadly has slowed.

Meanwhile, the BlackRocks and Vanguards of the world are increasingly targeting benchmarks comprised of companies which meet environmental, social and governance (ESG) standards.

The number of ESG indexes jumped by around 60% over the year to June, while "smart beta" products have also been popular -- indexes which track stocks with specific investment metrics such as earnings momentum.

While the rise of huge ETF funds has given investors low-cost exposure to more asset classes, some analysts worry it could cause contagion problems if stocks fall and investors redeem their funds en masse.

Yahoo Finance

Yahoo Finance