Graco (GGG) Q1 Earnings & Sales Miss Estimates, Decrease Y/Y

Graco Inc.’s GGG first-quarter 2024 adjusted earnings of 65 cents per share lagged the Zacks Consensus Estimate of 74 cents. The bottom line declined 12.2% year over year.

The company’s net sales of $492.2 million missed the consensus estimate of $535 million. The top line also decreased 7% year over year due to decreasing demand in the Industrial, Process and Contractor segments.

On a regional basis, quarterly sales generated from the Americas decreased 8% year over year. In Europe, the Middle East and Africa, sales increased 2% year over year. Sales from the Asia Pacific decreased 16% year over year.

Segmental Details

Revenues in the Industrial segment totaled $142 million (contributing to 28.9% of the quarter’s sales), decreasing 5% year over year. Our estimate for segmental revenues was $153.0 million. Core sales declined 5% year over year.

Revenues in the Process segment grossed $120 million (contributing to 24.4% of the quarter’s sales), decreasing 10% year over year. Our estimate for the segment’s revenues was $142.7 million. Core sales declined 10% year over year.

Revenues in the Contractor segment totaled $230 million (contributing to 46.7% of the quarter’s sales), down 6% year over year. Our estimate for segmental revenues was $241.3 million. Core sales declined 6% in the quarter.

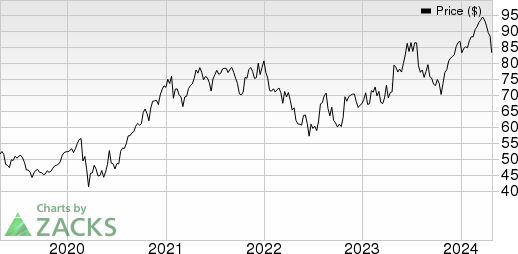

Graco Inc. Price, Consensus and EPS Surprise

Graco Inc. price-consensus-eps-surprise-chart | Graco Inc. Quote

Margin Profile

In the first quarter, Graco’s cost of sales declined 7.6% year over year to $226 million. Gross profit decreased 6.6% to $266.2 million while the margin rose 0.3 percentage points. The favorable effects of realized pricing benefited the margin’s performance.

Operating income decreased 15% year over year to $133.0 million. The operating margin decreased 2.6 percentage points from the year-ago quarter. Interest expenses in the first quarter totaled $744 million compared with $1.3 billion reported in the previous year. The adjusted effective tax rate in the quarter was 19.8% while the same for the first quarter of 2023 was 19.5%.

Balance Sheet and Cash Flow

Exiting the first quarter, Graco had cash and cash equivalents of $622.7 million compared with $538 million at the end of 2023.

It generated net cash of $118.9 million from operating activities in the first three months of 2024 compared with $90.8 million generated in the year-ago period. Capital used for purchasing property, plant and equipment totaled $37.2 million compared with $38.3 million in the year-ago period.

GGG, carrying a current Zacks Rank #2 (Buy), paid out dividends worth $42.9 million to its shareholders in the first three months of 2024, up 8.7% from the previous year. It didn’t repurchase any common stocks in the first three months of 2024. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Outlook

The company expects low single-digit organic revenue growth on a constant-currency basis for 2024.

Performance of Other Industrial Companies

IDEX Corporation’s IEX first-quarter 2024 adjusted earnings of $1.88 per share surpassed the Zacks Consensus Estimate of $1.75. On a year-over-year basis, the bottom line decreased approximately 10.1%.

In the quarter under review, IDEX’s net sales of $800.5 million underperformed the consensus estimate of $805 million. The top line also decreased 5.3% year over year.

A. O. Smith Corporation’s AOS first-quarter 2024 adjusted earnings of $1.00 per share surpassed the Zacks Consensus Estimate of 99 cents. The bottom line increased 6% on a year-over-year basis.

Net sales of $978.8 million missed the consensus estimate of $995 million. However, the top line inched up 1% year over year, driven by strong demand for commercial water heaters in North America.

W.W. Grainger, Inc. GWW reported earnings per share of $9.62 in first-quarter 2024, beating the Zacks Consensus Estimate of $9.58. The bottom line improved 0.1% year over year.

Grainger’s quarterly revenues rose 3.5% year over year to $4.24 billion. The top line missed the consensus estimate of $4.27 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance