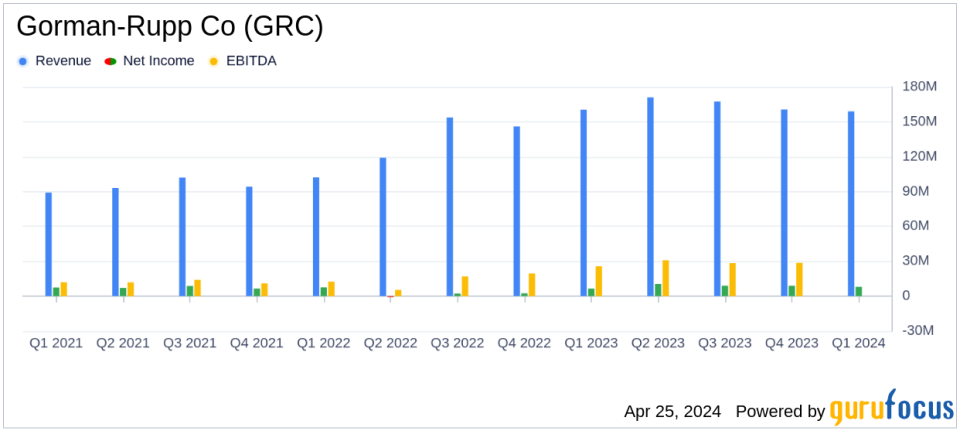

Gorman-Rupp Co (GRC) Q1 2024 Earnings: Misses Revenue Estimates, Aligns with EPS Projections

Revenue: $159.3M, down 0.7% year-over-year, falling short of estimates of $168.24M.

Net Income: $7.9M, up 21.1% from the previous year, below estimates of $9.52M.

Earnings Per Share (EPS): Reported at $0.30, up from $0.25 year-over-year, fell short of the estimated $0.34.

Gross Margin: Increased to 30.4% from 28.4% in the previous year, driven by a 230 basis point improvement in material costs.

Operating Income: Rose to $20.4M, achieving an operating margin of 12.8%, up from 11.9% year-over-year.

Backlog: Ended the quarter at $234.2M, up from $218.1M at the end of the previous quarter, indicating strong future revenue potential.

Net Cash Provided by Operating Activities: Decreased to $10.7M from $18.6M in the previous year, primarily due to increased working capital needs.

On April 25, 2024, Gorman-Rupp Co (NYSE:GRC) released its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company, a prominent player in the design, manufacture, and global sale of pumps and pump systems, reported a slight decrease in net sales to $159.3 million from $160.5 million in the previous year, falling short of the estimated $168.24 million. However, earnings per share met expectations at $0.30, consistent with analyst projections.

Company Overview

Gorman-Rupp Co operates primarily in one business segment, focusing on the manufacture and sale of pumps and pump systems. These products find extensive applications across various industries including water, wastewater, construction, and petroleum. The majority of its revenue is generated in the United States, maintaining a strong domestic market presence while also serving international markets.

Financial Performance and Challenges

The first quarter of 2024 saw Gorman-Rupp grappling with mixed financial results. While the company achieved a gross profit of $48.4 million with an improved gross margin of 30.4%, up from 28.4% in the previous year, net sales experienced a slight decline. This decrease in sales was attributed to a drop in international sales and specific market segments such as fire suppression and agriculture, which faced customer-related delays and adverse weather conditions, respectively.

Strategic Financial Achievements

Despite the sales dip, Gorman-Rupp reported several positive developments. The gross margin improvement was notably driven by a 230 basis point reduction in material costs and realized selling price increases. Additionally, the company's strategic management of SG&A expenses and operational efficiencies contributed to an operating income of $20.4 million, reflecting an operating margin of 12.8%, up from 11.9% in the prior year.

Detailed Financial Analysis

The balance sheet of Gorman-Rupp remains robust with total assets of $887.36 million. The company's efforts in managing its debt were evident, with a slight reduction in total debt, net of cash, to $381.6 million. Moreover, the firm's liquidity position is supported by $27.77 million in cash and cash equivalents.

From a cash flow perspective, net cash provided by operating activities amounted to $10.7 million, although this was lower than the previous year's $18.6 million, primarily due to increased working capital needs. The company's commitment to reinvestment is reflected in its capital expenditures of $3.9 million for the quarter, targeting machinery and equipment enhancements.

Executive Commentary

President and CEO Scott A. King emphasized the company's resilience amid challenges, stating,

We continued to deliver gross margin and earnings improvement despite sales being down slightly to last year. We had record incoming orders during the quarter, in part due to our municipal market, which includes flood control and storm water management applications. As a result, we saw an increase in backlog of $16 million during the quarter to $234.2 million."

Looking Forward

While the backlog remains elevated, Gorman-Rupp anticipates a normalization by year-end. The company remains optimistic about its full-year outlook, focusing on delivering profitable growth amidst fluctuating market conditions.

For more detailed financial information and future updates on Gorman-Rupp Co, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Gorman-Rupp Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance