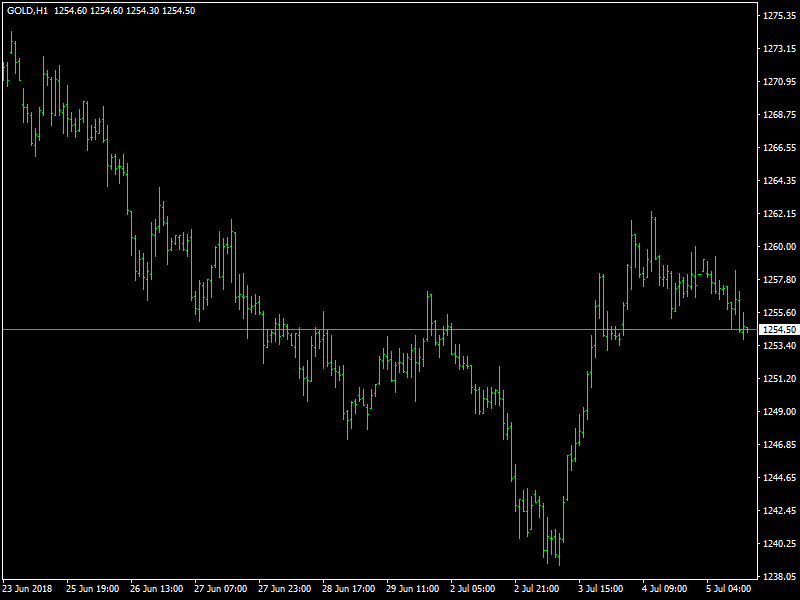

Gold Steady above $1250 Ahead of FOMC Minutes

Spot gold (XAUUSD) held steady at $1,256.02 an ounce as of 0047 GMT. The metal touched a one-week high at $1,261.10 in the prior session and gained over $20 from Tuesday’s low of $1,237.32 an ounce which was its weakest since Dec 12 and the U.S. gold futures were up 0.3% at $1,257.20 respectively.

The dollar index which measures the greenback against a basket of six major currencies was 0.1% lower at 94.565 as the holiday-thinned market saw global currencies move up against US Greenback. There’s not much incentive to move the market, it is very quiet this morning after the July 4 holiday. Investors are awaiting the outcome of a two-day U.S. Federal Reserve policy meeting to be announced at 2 p.m. EDT.

Silver Slow But Steady

The dollar-denominated precious metals remain at an impasse as political instability and escalating trade war triggers a buy signal with the steady U.S. dollar strength continues to nip those ideas in the bud. Silver (XAGUSD) moved back into the $16 territory as the holiday-thinned market saw precious metals matched against US Greenback make headway with global momentum weakening the US Dollar on account of the holiday.

The escalating trade row between Washington and Beijing, which triggered another sell-off in Asian stocks on Thursday, was also felt in oil markets, with China warning it could introduce duties on U.S. crude imports at an as yet unspecified date.

On Wednesday, Donald Trump accused the Organization of Petroleum Exporting Countries (OPEC) of driving up fuel prices and called out the Cartel to reduce the price immediately. Rouhani, who is currently on a lobbying mission in Europe in an effort to salvage the JCPOA deal (the Iran nuclear deal) and mitigate U.S. sanctions, has threatened that his country could block the Strait of Hormuz for all Arab shipping traffic if Washington fully implements its zero oil export targets for Iran in the coming months. WTIUSD is currently trading at $74.02 as investors observe the market for further proceedings in the global energy market.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance