Gold Prices Trying to Carve Support, But Will FOMC Cooperate?

DailyFX.com -

To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

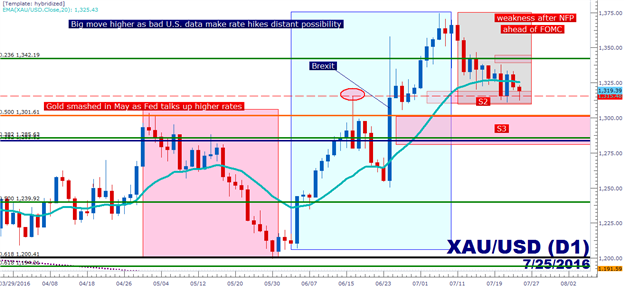

Gold Technical Strategy: Intermediate-term trend still bullish, but near-term price action bearish.

Gold has continued to temper gains ahead of this week’s FOMC announcement, and if the Fed does take a hawkish stance with eyes towards a potential hike in September, the retracement in Gold prices could run deeper.

If you’re looking for trading ideas, check out our Trading Guides. And if you want something more short-term in nature, check out our SSI indicator.

In our last article, we looked at Gold prices attempting to carve-out ‘higher-low’ support with the prospect of top-side continuation of the bullish trend. And in the article just before that, we had looked at just how overbought the recent up-trend in Gold prices had become, driven by a combination of fear-based risk aversion along with the expectation for even more monetary dovishness.

But as we approach another FOMC meeting later this week, it’s the questions revolving around monetary policy that may be giving continued pause to the up-trend in Gold prices. This is very similar to what happened in May, as the Fed talked up the prospect of a June rate hike and Gold prices plummeted from the $1,300 handle all the way down to $1,200. Of course, the Fed ended up relenting as U.S. data worsened; and this re-emergence of dovishness from the Fed had helped to catapult Gold prices higher again, just as we had seen in February and March of this year.

After a blowout NFP report earlier in the month and as U.S. stock prices sit at or near fresh all-time highs, the Fed has ample opportunity to talk up the prospect of rate hikes in the second half of this year; and if that takes place the expectation is that Gold will sell-off while the U.S. Dollar continues to firm. This is likely at least part of the reason for the near-term softness in Gold prices and a continued pause in the bullish-trend. The fact that Gold prices haven’t hit a new high since that most recent NFP report would confirm this thesis.

If the Fed does take on a hawkish stance towards hikes in the remainder of this year, with particular interest revolving around their next meeting in September, we’re likely going to see a deeper dive to a lower support level in Gold prices. The zone between $1,283.82-$1,301.61 could be especially interesting, as each price is a longer-term Fibonacci level. The price of $1,283.82 is 61.8% of the move from the 1999 low to the 2011 high (38.2% retracement of that move), while the price of $1,301.61 is 50% of the 2008 low to the 2011 high (the Financial Collapse Move). This is the same price zone that we had identified two weeks ago as our ‘S3’ zone of support, and should price action move down to this region, traders can begin looking for support in the effort of top-side continuation.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance