Gold Prices Likely to Trade Lower as Recovery Falls Flat

Receive the Weekly Speculative Sentiment Index report via PDF via David’s e-mail distribution list.

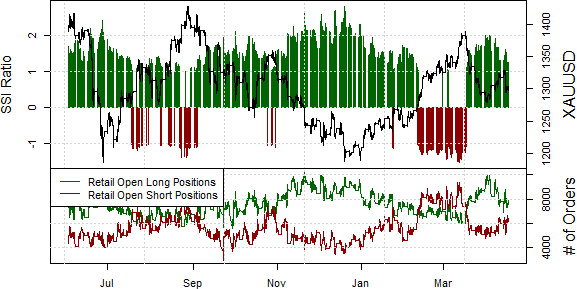

GOLD – One-sided forex trading sentiment and a key technical failure leave us focused on further Gold price weakness until further notice.

Trade Implications GOLD – Last week we wrote in favor of further Gold price recovery on account of a fairly strong shift in crowd positioning; retail traders had sold aggressively into the XAUUSD bounce. Yet the precious metal has since stopped and reversed in fairly dramatic fashion, and ‘the herd’ is once again aggressively long. A daily close below the key $1300 mark would further confirm losses are likely.

See next currency section: AUDUSD - Australian Dollar Rally at Clear Risk on Two Factors

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

Automate our SSI-based trading strategies via Mirror Trader free of charge

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance