Gold Prices Breach Range Support Ahead of Key Yellen Speech

DailyFX.com -

Talking Points:

Gold prices drop through range floor on Glencore output sale

Crude oil prices resume descent as EIA reports inventory build

Yellen speech may overshadow US Durable Goods Orders data

Gold prices turned sharply lower following news that Glencore Plc agreed to sell A$880 million in future output to Evolution Mining Ltd, Australia’s second-largest producer. The latter firm said this would boost their overall output for the current fiscal year to as much as 860k ounces. That would amount to a 7 percent gain from the prior year.

Crude oil prices also declined after weekly EIA inventory data revealed a build of 2.5 million barrels. Economists were expecting a drawdown of 850k but a private-sector estimate from API published yesterday foreshadowed the direction of the outcome (albeit not the magnitude), pointing to a gain of 4.46 million barrels.

Looking ahead, July’s US Durable Goods Orders report headlines the economic calendar, with forecasts pointing to a 3.4 percent gain after a 3.9 percent decline in the prior month. The outcome seems unlikely to generate lasting follow-through however as investors wait to hear a much-anticipated speech from Fed Chair Janet Yellen on Friday before showing directional conviction.

Are gold and crude oil trends matching DailyFX analysts’ expectations? Find out here!

GOLD TECHNICAL ANALYSIS – Gold prices broke out lower after two weeks of standstill, sinking to the weakest level in a month. From here, a daily close below the 1303.62-08.00 area (May 2 high, 38.2% Fibonacci retracement) exposes the 50% level at 1287.29. Alternatively, a move back above support-turned-resistance in the 1329.79-33.62 zone (August 8 low, 23.6% Fib) targets a falling trend line at 1352.91.

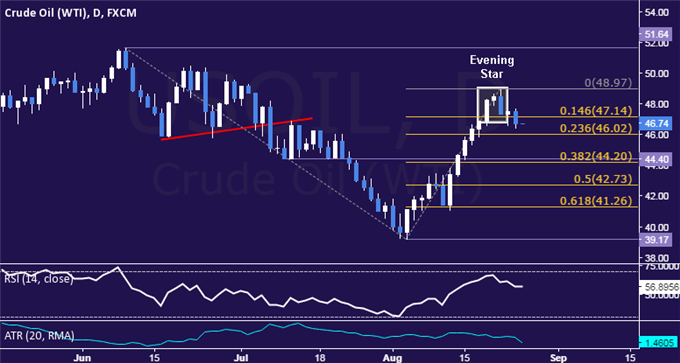

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices continued to push lower after signaling topping with the formation of an Evening Star candlestick pattern. Near-term support is at 46.02, the 23.6% Fibonacci expansion, with a break below that on a daily closing basis exposing the 44.20-40 area (July 11 low, 38.2% level). Alternatively, a reversal above the 14.6% Fib at 47.14 targets the August 22 high at 48.97.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance