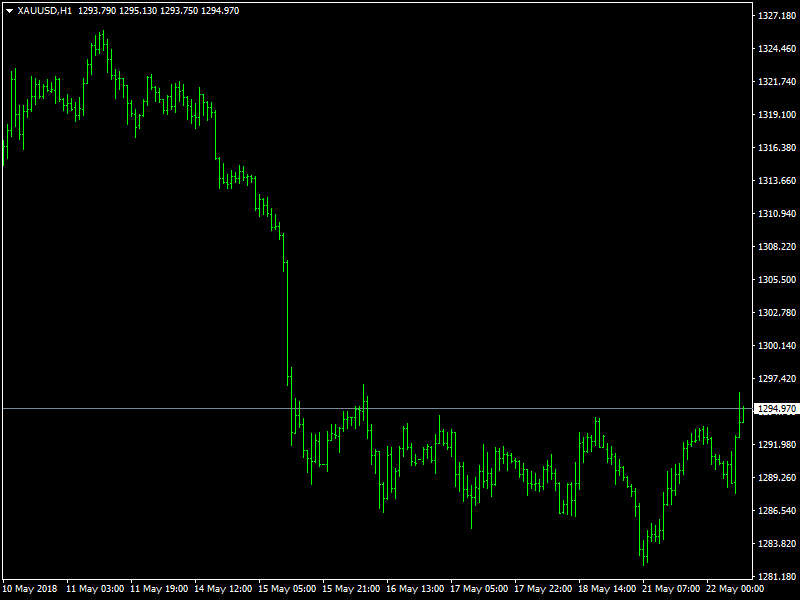

GOLD Gains Momentum over Mixed Signals from FOMC Members

The greenback slowed down during yesterday trading session owing to a mixed signal from FOMC members and flat yields from US treasury notes, Yellow metal started gaining against the greenback and is currently trading at $1295.60. Two of three FOMC members sounded dovish during their speech on later American session and early Asian market hours. If various members of Fed continue to express less hawkish outlook for monetary policy in days to come, Gold price is expected to see a rebound.

Investors are currently on the lookout for FOMC minutes and speech by New York Fed President William Dudley and Chairman Jerome Powell later this week and their comments could boost the appeal of gold should they tame expectations for a more aggressive approach in normalizing monetary policy.

Silver markets initially dipped during the day on Monday but found enough support at the $16.25 level to bounce significantly and crash into the $16.50 level reaching as high as $16.60 during early Asian trading session. Silver has proved resilient against global tensions and short-term volatilities triggered by the speech from key people across the globe maintaining its stand above $16 and this has attracted a significant amount of investors to keep a stash invested in Silver on a longer time frame.

Crude oil (WTI/USD) closed around $72.53 in US session on Monday, soared by almost 1.06% to on Venezuelan and Iran tensions and ease of trade war concern after US-China trade tussles put “on hold” by US Treasury secretary Mnuchin. During Asian trading hours, WTIUSD reached as high as $72.77 per barrel and is currently trading at $72.55. A key report shows that Oil inventories in the world’s richest nations have now fallen 1 million barrels below the five-year average, the level targeted by the Organization of the Petroleum Exporting Countries and its partners, as the group restrains crude output for the second year.

This along with the fear of possible US Sanction reducing the Crude Oil Output from Venezuela has currently caused Crude Oil bulls to soar to new heights, Investors are now expecting WTIUSD to hit as high as $75 per barrel before the end of this month.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance