Gentherm Inc (THRM) Reports Q1 2024 Earnings: Surpasses EPS Expectations Amid Revenue Decline

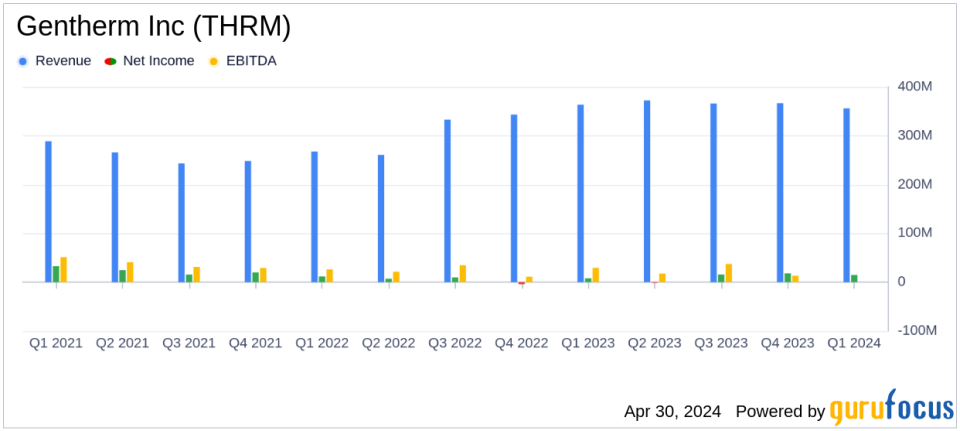

Revenue: Reported at $356.0 million, down 2.1% year-over-year, falling short of estimates of $358.53 million.

Net Income: Achieved $14.78 million, exceeding estimates of $14.12 million with an 86% increase from the prior year.

Earnings Per Share (EPS): GAAP diluted EPS was $0.47, surpassing the estimated $0.43 and up from $0.24 year-over-year.

Gross Margin: Increased to 24.9% from 22.3% in the prior year, driven by cost reductions and productivity improvements.

Automotive Revenue: Decreased by 2.3% year-over-year; however, excluding foreign currency impacts and other factors, it showed a slight increase of 0.1%.

Adjusted EBITDA: Grew by 4.9% to $43.5 million, reflecting operational efficiencies and strategic initiatives.

Guidance: Reaffirmed full-year 2024 guidance with product revenues expected between $1.5 billion and $1.6 billion and adjusted EBITDA margin between 12.5% and 13.5%.

Gentherm Inc (NASDAQ:THRM), a leading provider of thermal management technologies, released its 8-K filing on April 30, 2024, detailing the financial outcomes for the first quarter ended March 31, 2024. Despite a slight decline in product revenues, the company achieved significant growth in net income and surpassed earnings per share (EPS) expectations, highlighting its robust operational efficiency and strategic initiatives.

Financial Performance Overview

For Q1 2024, Gentherm reported product revenues of $356.0 million, a decrease of 2.1% from $363.6 million in Q1 2023. This decline was slightly below the estimated revenue of $358.53 million. The automotive segment, which forms the core of Gentherm's business, saw a revenue decrease of 2.3% year-over-year. However, adjusted for foreign currency translation and other factors, automotive revenues showed a marginal increase of 0.1%. Notably, revenues from Automotive Climate and Comfort Solutions rose by 2.2% compared to the previous year, outperforming actual light vehicle production in key markets.

The company's net income for the quarter was a standout at $14.785 million, marking an 86% increase from the previous year and surpassing the estimated net income of $14.12 million. Earnings per share (EPS) also exceeded expectations, with GAAP diluted EPS at $0.47 compared to an estimated $0.43. Adjusted diluted EPS was $0.62, up from $0.49 in the prior-year period.

Strategic Achievements and Operational Highlights

Gentherm's President and CEO, Phil Eyler, highlighted the company's strategic wins and operational efficiencies. The company secured $530 million in new automotive business awards, including a significant contract with General Motors for their next-generation truck platform. The Fit-for-Growth 2.0 initiatives contributed to a gross margin rate improvement, rising to 24.9% from 22.3% in the prior-year period, driven by supplier cost reductions and increased productivity.

I am proud of the Gentherm teams solid execution to start the year. We continue to see strong demand from OEMs for our thermal comfort, massage, and lumbar solutions and secured $530 million dollars of automotive new business awards, setting a record for a first quarter.

Challenges and Forward-Looking Statements

Despite the positive outcomes, Gentherm faces challenges including a volatile global production environment and the phasing out of its non-automotive electronics business. The company reaffirmed its full-year 2024 guidance, expecting product revenues between $1.5 billion and $1.6 billion and an adjusted EBITDA margin between 12.5% and 13.5%.

Conclusion and Investor Outlook

Gentherm's Q1 2024 results demonstrate its ability to navigate market challenges effectively, achieving profitability improvements and securing significant new business in a competitive sector. Investors and stakeholders may look forward to continued growth and operational enhancements as the company progresses through 2024.

For further details, join Gentherm's conference call or access the webcast on the company's investor relations website. For direct inquiries, contact Gentherm's investor relations at investors@gentherm.com.

Gentherm Inc continues to lead in thermal management solutions, with a promising outlook for sustaining growth and enhancing shareholder value in the evolving automotive and medical industries.

Explore the complete 8-K earnings release (here) from Gentherm Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance