Gentex Corp (GNTX) Q1 2024 Earnings: Close Call with Analyst Estimates Amidst Market Challenges

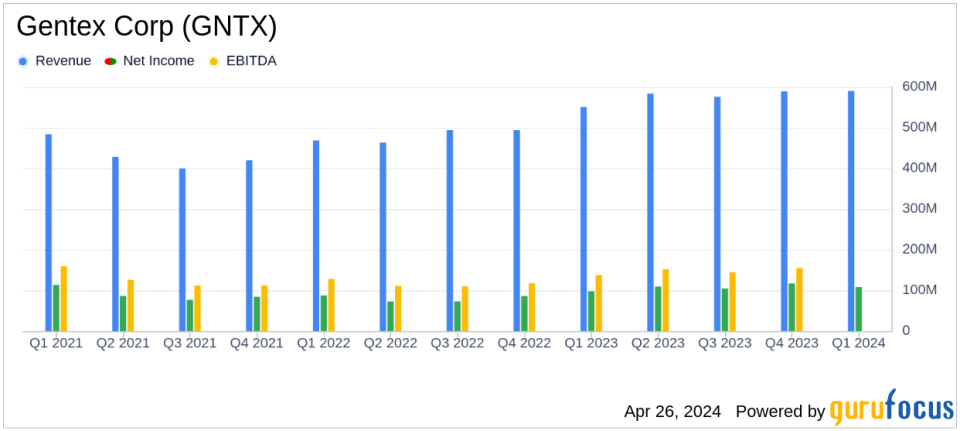

Revenue: Reported $590.2M, up 7% year-over-year, falling slightly below estimates of $598.01M.

Net Income: Reached $108.2M, an 11% increase year-over-year, falling short of estimates of $109.61M.

Earnings Per Share: Achieved $0.47, up 12% from the previous year, below the estimated $0.48.

Gross Margin: Improved to 34.3%, up 260 basis points from the previous year, indicating efficiency gains and cost management.

Income from Operations: Increased to $129.3M, marking a 14% rise compared to the first quarter of 2023.

Share Repurchases: Repurchased 1.2 million shares at an average price of $35.84 per share, with 14.7 million shares still available under the buyback plan.

Future Guidance: Maintains 2024 revenue guidance of $2.45B to $2.55B and gross margin expectations of 34% to 35%.

Gentex Corp (NASDAQ:GNTX), a pioneer in digital vision and connected car technologies, disclosed its financial outcomes for the first quarter of 2024 on April 26, 2024. The company announced these details in its recent 8-K filing. Despite a decline in light vehicle production, Gentex achieved a new quarterly sales record of $590.2 million, which, although slightly below the analyst's expectation of $598.01 million, still marks a 7% increase year-over-year. The earnings per share (EPS) stood at $0.47, closely aligning with the forecast of $0.48.

Company Overview

Founded in 1974, Gentex Corporation initially focused on smoke-detection technologies before pivoting to automotive applications. The company has been at the forefront of producing electrochromic mirrors since 1982. Automotive products now constitute approximately 98% of its revenue. Based in Zeeland, Michigan, Gentex continues to innovate, expanding its technology applications across various sectors, including dimmable aircraft windows and fire protection products.

Financial Performance and Market Challenges

The first quarter of 2024 saw Gentex achieving a gross margin of 34.3%, a significant improvement from 31.7% in the same quarter last year, thanks to cost reductions and manufacturing efficiencies. However, the company faced headwinds due to a 3% decline in vehicle production in its primary markets of North America, Europe, and Japan/Korea. Despite these challenges, Gentex's revenue outperformed the underlying market by 10%, attributed to strong content growth from higher launch rates of Full Display Mirrors and other advanced features.

Operational Highlights and Future Outlook

Operating expenses for Q1 2024 rose to $72.9 million, up 19% from the previous year, driven by increased investments in research and development, including the integration of the eSight team. Looking ahead, Gentex remains committed to its margin recovery plan, aiming for a gross margin range of 34% to 35% for 2024, with further improvements expected by year-end.

The company's balance sheet remains robust, with significant increases in total assets from $2.61 billion at the end of 2023 to $2.71 billion as of March 31, 2024. Gentex also continued its shareholder-friendly activities, repurchasing 1.2 million shares during the quarter.

Strategic Moves and Market Position

Despite the current market volatility, Gentex is well-positioned for future growth. The company's strategy to diversify its product offerings and reduce dependency on light vehicle production volumes is paying off, allowing it to navigate the downturn in vehicle production more effectively than many of its peers.

In conclusion, Gentex Corp (NASDAQ:GNTX) has demonstrated resilience in a challenging market by posting record sales and improving profit margins. With strategic investments in technology and a strong focus on operational efficiency, Gentex appears poised to maintain its leadership in the automotive and related technologies sector. Investors and stakeholders may look forward to potentially rewarding outcomes as the company continues to execute its growth and efficiency strategies.

Explore the complete 8-K earnings release (here) from Gentex Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance