General Dynamics' (GD) Q1 Earnings Beat, Revenues Up Y/Y

General Dynamics Corporation GD reported first-quarter 2021 earnings from continuing operations of $2.48 per share, which exceeded the Zacks Consensus Estimate of $2.31 by 7.4%. Moreover, earnings improved 2.1% from $2.43 in the year-ago quarter.

Total Revenues

General Dynamics’ first-quarter revenues of $9,389 million surpassed the Zacks Consensus Estimate of $8,977 million by 4.6%. Further, revenues improved 7.3% from $8,749 million in the year-ago quarter. The decline was primarily attributable to growth in all four segments, especially the Aerospace and Marine Systems segments which saw more than 10% improvement.

Backlog

The company recorded a total backlog of $89.6 billion, up 4.5% year over year. Funded backlog at the quarter-end was $41.8 billion.

Segment Performance

Aerospace: The segment reported revenues of $1,887 million, up 11.6% year over year. Operating earnings of $220 million declined 8.3% from the prior-year quarter’s $240 million.

Combat Systems: Segment revenues improved 6.6% from the prior-year quarter to $1,708 million. Moreover, operating earnings were up 9.4% from the year-ago quarter to $244 million.

Technologies: The segment reported revenues of $3,199 million, which increased 3.1% year over year. Operating earnings of $306 million grew 2.7% from the prior-year quarter’s $298 million.

Marine Systems: The segment’s revenues of $2,483 million were up 10.6% from the year-ago quarter’s $2,246 million. Operating earnings also improved 8.7% year over year to $200 million.

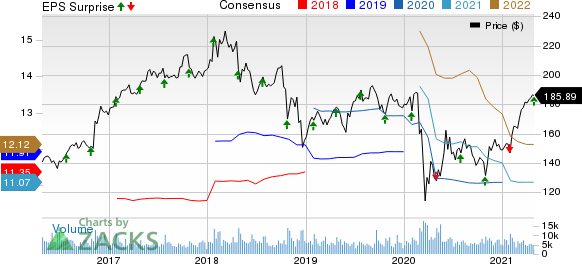

General Dynamics Corporation Price, Consensus and EPS Surprise

General Dynamics Corporation price-consensus-eps-surprise-chart | General Dynamics Corporation Quote

Operational Highlights

The operating margin contracted 70 basis points (bps) to 10% from the year-ago quarter’s 10.7%.

In the quarter under review, General Dynamics’ operating costs and expenses rose 8.1% to $8,451 million.

Financial Condition

As of Apr 4, 2021, General Dynamics’ cash and cash equivalents were $1,811 million compared with $2,824 million as of Dec 31, 2020.

Long-term debt as of Apr 4, 2021, was $9,995 million, which remained flat compared to the 2020-end level.

As of Apr 4, 2021, the company’s cash inflow from operating activities was $3 million against $666 million used in the year-ago period.

Free cash outflow from operations at the end of the first quarter of 2021 was $131 million compared with $851 million at the end of the first quarter of 2020.

Zacks Rank

General Dynamics currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Lockheed Martin Corp. LMT reported first-quarter 2021 earnings of $6.56 per share, which surpassed the Zacks Consensus Estimate of $6.32 by 3.8%.

Hexcel Corporation HXL reported first-quarter 2021 loss of 10 cents per share, which was narrower than the Zacks Consensus Estimate of a loss of 16 cents.

Raytheon Technologies Corp’s RTX first-quarter 2021 adjusted earnings per share of 90 cents outpaced the Zacks Consensus Estimate of 88 cents by 2.3%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance