Gen Z Aussies went mad for shares last year

Young Australians flocked to shares in record numbers last year, trying to catch the last wave of a ten-year bull market.

The number of generation Z investors, according to National Australia Bank’s trading arm nabtrade, increased by 73 per cent last year — while generation Y saw a 20 per cent leap.

Generation Z was defined by the research as investors under 24 years old and generation Y was equivalent to those aged 24 to 37.

“Over the past two years, we have seen a significant rise in the number of young investors turning to the sharemarket for wealth creation,”’ said nabtrade investor behaviour director Gemma Dale.

“These are serious investors, who are studying the local and international share markets closely and buying shares they know, and investing for the long term.”

Overall the number of customers with local stocks increased 13 per cent, but demand for international shares surged by 30 per cent last year.

“Australian investors, particularly younger investors, understand that while the Australian sharemarket offers some great opportunities, many critical, fast-growing sectors are not well represented on the local bourse,” Dale said.

“These investors are generally pursuing two key thematics – technology, and the rise of the Asian consumer, and they’re choosing to do that directly into the US or Asian markets.”

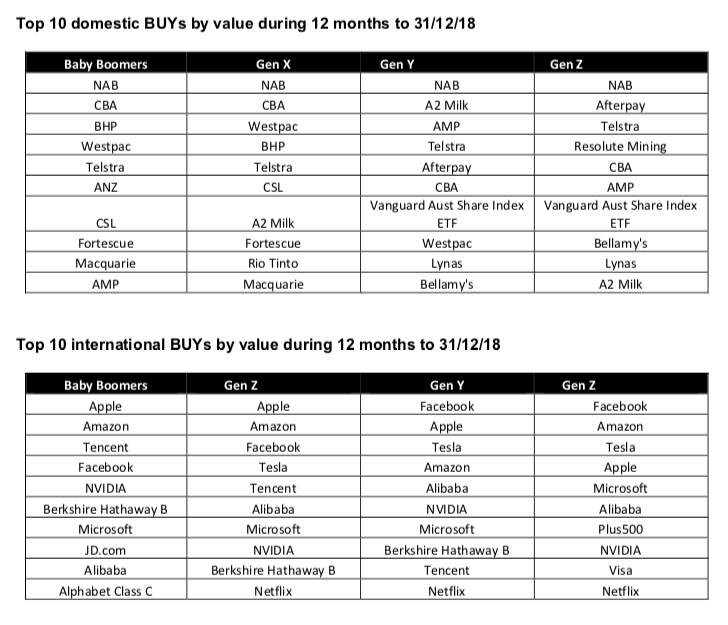

Generation Y now represented the biggest demographic that traded in international stocks. Facebook, Apple, Tesla and Amazon were the four most popular purchases in that age group, as well as generation X (38 to 53 years old) and Z. Chinese tech giant Tencent crept into the top four among baby boomers (54 to 72 years old).

Investors also reweighted the industries that they were exposed to as the year wore on, with baby boomers and generation X shying away from the finance, consumer discretionary and telecommunications sectors.

“But [boomers and gen X] increased their holdings in healthcare, consumer staples and material stocks,” Dale said.

“This reflects their concerns about headwinds facing these sectors but is also a recognition of how heavily overweight some of these much-loved sectors had been for long term investors.”

Generation Y went slightly the other way, increasing their investment in finance — but still reducing their exposure in consumer discretionary and telcos, while materials, healthcare also saw sell-offs.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Read next: McDonald’s worker wins compo for smoko injury

Read next: 10 biggest capital raises by Australian startups in 2018

Read next: Mastercard blocks companies auto-charging after ‘free trial’ period

Yahoo Finance

Yahoo Finance