GE Aerospace Surpasses Q1 Revenue Estimates and Raises Full-Year Guidance

Total Orders: Reached $11.0B, marking a 34% increase year-over-year.

Adjusted Revenue: Grew to $8.1B, up 15% from the previous year, surpassing the estimated $7.0B.

Operating Profit: Rose to $1.5B, a 24% increase, with an operating profit margin expansion of 140 basis points to 19.1%.

Free Cash Flow: Increased significantly to $1.7B, up from $0.8B, demonstrating a strong improvement in liquidity.

Full-Year Guidance: Raised, with expected operating profit now between $6.2B and $6.6B and adjusted EPS forecasted at $3.80 to $4.05.

Strategic Investments: Announced over $650 million in investments for manufacturing facilities and supply chain enhancements.

Shareholder Returns: Initiated a substantial dividend increase and a $15 billion share buy-back program.

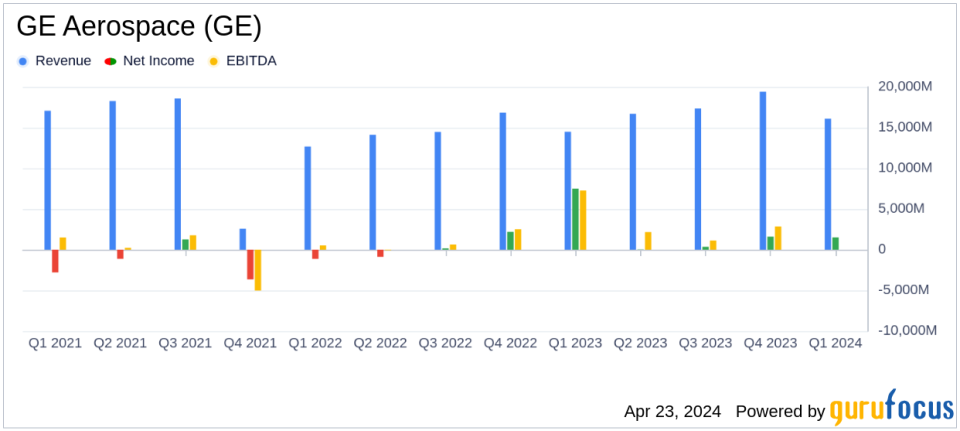

On April 23, 2024, GE Aerospace (NYSE:GE) announced its first-quarter earnings for the year, revealing significant growth and operational success. The company's financial achievements were detailed in its 8-K filing, which also marked the successful spin-off of GE Vernova Inc., now a separate entity reporting independently.

Company Overview

GE Aerospace, a leader in aerospace propulsion, services, and systems, has a substantial global presence with approximately 44,000 commercial and 26,000 military aircraft engines in operation. With a workforce of 52,000, the company continues to build on a century of innovation, defining the future of flight and ensuring safe and efficient travel.

First Quarter Financial Highlights

The first quarter showed a robust performance with total orders of $11.0 billion, marking a 34% increase year over year. Adjusted revenue grew by 15% to $8.1 billion, driven by strong demand in both commercial engines and defense propulsion technologies. The operating profit followed suit, with a 24% increase to $1.5 billion, and operating profit margin expanded by 140 basis points to 19.1%. This growth is attributed to effective pricing strategies and increased service volume.

GE Aerospace's free cash flow was particularly impressive, doubling from the previous year to $1.7 billion. This financial strength has enabled the company to raise its full-year profit and cash flow guidance, reflecting confidence in continued operational success and market leadership.

Strategic Developments and Market Position

Under the leadership of Chairman and CEO H. Lawrence Culp, Jr., GE Aerospace has initiated several strategic actions to enhance its market position. The introduction of FLIGHT DECK, a new lean operating model, aims to streamline operations and bridge strategy with tangible results. The company also highlighted its future outlook at the recent Investor Day, projecting an operating profit of $10 billion by 2028 and announcing a significant share buy-back program and a dividend increase.

Additionally, GE Aerospace has committed over $650 million towards upgrading its manufacturing facilities and strengthening its supply chain. This investment underscores the company's commitment to innovation and quality in its offerings.

Analysis of Financial Performance

Comparing GE Aerospace's performance with analyst estimates, the company has notably surpassed expectations. Analysts projected an earnings per share of $0.66 and revenue of $15,344.75 million for the quarter, but GE Aerospace exceeded these figures with an adjusted EPS of $0.82 and adjusted revenue of $15.2 billion. This outperformance highlights the company's efficient operational management and strong market demand.

Looking ahead, GE Aerospace has updated its 2024 full-year guidance, now expecting adjusted revenue growth in the low double digits and an operating profit between $6.2 billion and $6.6 billion. The adjusted EPS is forecasted to be between $3.80 and $4.05, with free cash flow expected to exceed $5 billion.

Conclusion

GE Aerospace's first-quarter results demonstrate a solid start to 2024, underscored by strategic investments and robust financial performance. As the company continues to innovate and expand its market reach, investors and stakeholders can anticipate continued growth and profitability from this aerospace leader.

For detailed insights and further information, refer to the official GE Aerospace Investor Relations page.

Explore the complete 8-K earnings release (here) from GE Aerospace for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance