GBP/USD to Mount Larger Rebound on Strong U.K. CPI Report

DailyFX.com -

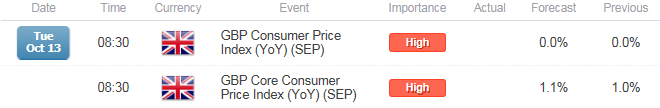

- Headline U.K. Consumer Price Index (CPI) to Hold Flat for Second Consecutive Month.

- Core Rate of Inflation to Uptick to Annualized 1.1% in September.

Trading the News: U.K. Consumer Price Index

Even though the headline reading for the U.K. Consumer Price Index (CPI) is projected to hold flat for the second consecutive month in September, an uptick in the core rate of inflation may generate a larger rebound in GBP/USD as its puts increased pressure on the Bank of England (BoE) to lift the benchmark interest rate off of the record-low.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Signs of a stronger recovery accompanied by increasing price pressures may spark a greater dissent within the Monetary Policy Committee (MPC) and push Governor Mark Carney to adopt a more hawkish outlook for monetary policy as it raises the risk of overshooting the 2% target for inflation.

For more updates, sign up for David's e-mail distribution list.

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

CBI Reported Sales (SEP) | 28 | 49 |

Retail Sales ex Auto Fuel (MoM) (AUG) | 0.1% | 0.1% |

Average Weekly Earnings ex. Bonus (3MoY) (JUL) | 2.9% | 2.9% |

Greater consumption paired with stronger wage growth may encourage a stronger-than-expected CPI print, and heightening price pressures may encourage the BoE to normalize monetary policy sooner rather than later as the central bank sees a ‘solid’ recovery ahead.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

Trade Balance (AUG) | -2.150B | -3.268B |

BRC Shop Price Index (YoY) (SEP) | -- | -1.9% |

Net Consumer Credit (AUG) | 1.2B | 0.9B |

However, the underlying strength in the sterling along with the slowdown in private lending may weigh on price growth, and a dismal inflation report may generate a bearish reaction in the British Pound as it drags on interest rate expectations.

How To Trade This Event Risk(Video)

Bullish GBP Trade: Core Inflation Upticks to Annualized 1.1% or Higher

Need green, five-minute candle following the release to consider a long British Pound trade.

If market reaction favors bullish sterling trade, long GBP/USD with two separate position.

Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: U.K. CPI Report Falls Short of Market Forecast

Need red, five-minute candle to favor a short GBP/USD trade.

Implement same setup as the bullish British Pound trade, just in reverse.

Read More:

GBP/USD Retail FX Positioning Continues to Narrow From Extremes

Webinar: USD Weakness Targets Key Support- Comm Bloc Overstretched?

Potential Price Targets For The Release

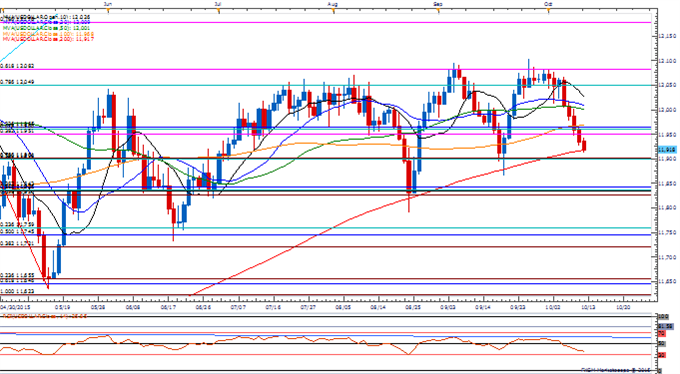

GBPUSD Daily

Chart - Created Using FXCM Marketscope 2.0

GBP/USD may face a larger rebound following the failed attempt to test the May low (1.5089), but the pair remains at risk of carving a lower-high after carving a lower-low earlier this month.

DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long GBP/USD since August 21, but the ratio continues to come off of recent extremes as it narrows to +2.05, with 67% of traders long.

Interim Resistance: 1.5640 (50% expansion) to 1.5650 (38.2% expansion)

Interim Support: 1.5089 (May low) to 1.5090 (61.8% retracement)

Join DailyFX on Demandfor Real-Time Updates on the DailyFX Speculative Sentiment Index!

Impact that the U.K. Core CPI report has had on GBP during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

AUG 2015 | 9/15/2015 08:30 GMT | 1.0% | 1.0% | -2 | -88 |

August 2015 U.K. Core Consumer Price Index

The U.K. Consumer Price Index (CPI) held flat in August after expanding an annualized 0.1% in July, while the core rate of inflation slowed to 1.0% from 1.2% in July. Even though Bank of England (BoE) Governor Mark Carney continues to prepare U.K. households and businesses for higher borrowing-costs, the disinflationary environment across the major industrialized economies may encourage the central bank to further delay its normalization cycle in an effort to encourage a stronger recovery. Despite the initial tick higher, the market reaction was short-lived, with GBP/USD losing ground throughout the North American trade to end the day at 1.5342.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance