Garmin's (GRMN) Q3 Earnings & Revenues Surpass Estimates

Garmin Ltd. GRMN reported third-quarter 2019 pro-forma earnings of $1.27 per share, beating the Zacks Consensus Estimate of 94 cents. Moreover, the figure improved 27% on a year-over-year basis and 9.5% sequentially.

Net sales came in $934.38 million, up 15% from the year-ago quarter but down 2.1% from the third quarter. The top line outpaced the Zacks Consensus Estimate of $863.92 million.

Strong performance of its fitness, outdoor, marine and aviation segments drove the year-over-year top-line growth.

Management is focused on continued innovation, diversification and market expansion to explore growth opportunities in all its business segments.

Segmental Revenues

Outdoor (28% of net sales): The segment generated third-quarter sales of $258.3 million, improving 23% year over year. The year-over-year increase was primarily driven by robust demand for Garmin’s adventure watches.

Fitness (26%): This segment generated sales of $243.1 million, which increased 28% from the year-ago quarter. This can be primarily attributed to its well-performing running wearables. Further, positive contributions from the Tacx buyout were positives.

Aviation (20%): The segment generated sales of $187.6 million, improving 28% on a year-over-year basis. This can be primarily attributed to the well-performing OEM and aftermarket systems. Further, the company’s solid momentum in the OEM category contributed to the impressive results.

Marine (12%): Garmin generated sales of $107.7 million from this segment, increasing 9% on a year-over-year basis. The company witnessed growing demand for chartplotters during the reported quarter ,in turn driving the segment’s topline.

Auto (14%): This segment generated sales of $137.7 million, down 17% from the prior-year quarter. The decline was mainly due to shrinking of the personal navigation device market.

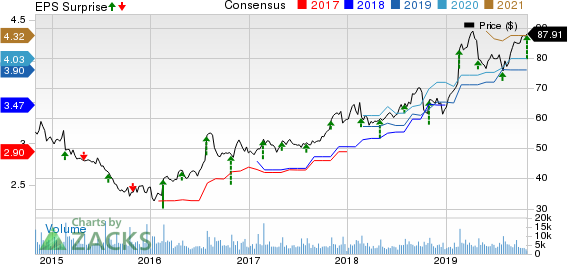

Garmin Ltd. Price, Consensus and EPS Surprise

Garmin Ltd. price-consensus-eps-surprise-chart | Garmin Ltd. Quote

Revenues by Geography

Americas: Garmin generated sales of $439.1 million (47% of net sales) from this region during the reported quarter, up 19% year over year.

EMEA:This region generated sales of $344.01 million (37%), up 12% on a year-over-year basis.

APAC:The company generated sales of $151.3 million (16%) from this region, increasing 14% from the year-ago quarter.

Operating Results

In the third quarter, gross margin was 60.7%, which expanded 130 basis points (bps) from the year-ago period.

The company’s operating expenses of $306 million were up 7.4% from the prior-year quarter. However, as a percentage of revenues, the figure contracted 240 bps year over year to 32.7%

Additionally, operating margin of 28% in the reported quarter expanded 380 bps year over year.

Balance Sheet & Cash Flow

At the end of the third quarter, cash, cash equivalents and marketable securities came in $1.28 billion, higher than $1.06 billion in the second quarter.

Inventories were $749.8 million compared with $648.1 million in the second quarter. We note that the company had no long-term debt in the reported quarter.

At the end of the third quarter, the company generated cash flow of $189 million from operating activities. Free cash flow totaled $158 million.

2019 Guidance

For 2019, Garmin has raised its guidance for pro-forma earnings from $3.90 to $4.15 per share. The Zacks Consensus Estimate for earnings is pegged at $3.90 per share.

Further, the company also upwardly revised its view for revenues from $3.6 billion to $3.65 billion. The Zacks Consensus Estimate for revenues is pegged at $3.60 billion.

This upward revisionis primarily attributed to rise in growth estimates for revenues in aviation, fitness and outdoor segments. For aviation, growth is now projected at 20%, higher than the previous estimate of 17%. Further, growth estimate for fitness jumped from 13% to 16%.

Additionally, the percentage of decline in the auto segment remains unchanged at 15%.

Further, the company expects gross and operating marginsto be 59.5% and 24.3%, respectively, for 2019.

Zacks Rank & Key Picks

Garmin currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector include Itron, Inc. ITRI, Booking Holdings Inc. BKNG and Ambarella, Inc. AMBA. While Itron sports a Zacks Rank #1 (Strong Buy), Booking Holdings and Ambarella carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Itron, Booking Holdings and Ambarella is currently projected at 25%, 13.08% and 11.18%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ambarella, Inc. (AMBA) : Free Stock Analysis Report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance