FTSE 100 Tech Update: Neckline Holding (For Now)

DailyFX.com -

What’s inside:

The FTSE 100 is bouncing from support

Need to wait for a confirmed break of the neckline before the H&S top is validated

Support and resistance levels outlined

For educational material and trade ideas, see our trading guides.

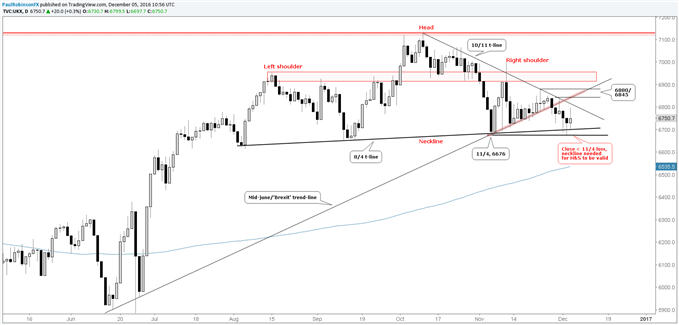

On Friday, the FTSE 100 came within less than 3 points of the important 11/4 low before paring most of its losses. The bounce from support also put the index back above the neckline of the head-and-shoulders pattern developing since August.

Today, thus far, we are seeing small follow-through on Friday’s hold of key support. If we are to soon see a resolution of the broad H&S topping pattern, any push higher is likely to lack power and quickly find resistance difficult to overcome. The trend-line off the 10/11 pop to new record highs is our first reference of resistance. Not far beyond the downtrend line the market will face a retest of the broken June trend-line the FTSE held for much of November. Price resistance arrives at the 11/30 rejection day high of 6845, and then the 11/23 swing high of 6880.

For the topping pattern to officially trigger, a daily closing bar below the 8/4 trend-line/neckline and 11/4 low at 6676 will be required. This could happen tomorrow, it may not happen until next month. It may not happen at all. For now, we will respect support until broken, but it seems as though time is running out before we will see the pattern trigger.

FTSE 100: Daily

Created with Tradingview

For a list of live events with trading outlooks, key news coverage, and educational content, please see our webinar calendar.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance