FTSE 100: Bounce or Beginning of a Sustainable Advance?

DailyFX.com -

What’s inside:

The FTSE 100 springs to life after failing to sustain trade below previous record peaks

The index is working on a higher high in the short-term, breaking the downtrend off the highs

Watching how pullback develops and support is treated should it get tested

Looking for trading ideas? See our Trading Guides

Last week, after three days of attempting to make a lasting break below prior record highs the FTSE 100 sprang to life to end the week. On Thursday, sterling took a hit following the BoE meeting, which helped give the footsie a lift (FTSE vs. GBP 1-mo correlation = -91%). More currency weakness very likely means more stock market strength and in reverse if sterling rallies. At least that is what the correlation is telling us. But relationships between markets often change without notice, even if only a short-term derailing, so let’s look at the footsie in a bubble.

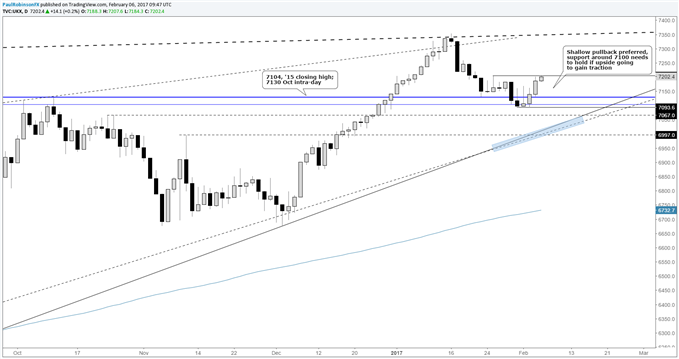

Looking out over the short-term the 100 index is working on making a higher high above the swing high (7206) created during the bounce towards the end of January. This would be the first breakage in the near-term downtrend, back in line with the broader uptrend. A shallow dip soon would be welcomed. We will have an opportunity on weakness see how market participants want to treat the current advance; bounce or beginning of a sustainable rally.

The October intra-day high of 7130 down to the Thursday low of 7093 is the zone of support the market needs to hold for now. Again, preferably we don’t see such a deep pullback if the market is to trade higher. But should we see decline begin to unfold, the area around 7100 needs to hold to stave off any notions of the current move higher acting as nothing more than a bounce.

We don’t expect the market to trade higher in the same extremely persistent fashion as it did from the beginning of December to the middle of last month. Those kind of market moves aren’t commonplace. Market conditions are expected to be more on the side of choppiness for now, regardless of its direction.

FTSE 100: Daily

Created with Tradingview

See the Webinar Calendar for a schedule of upcoming live events with DailyFX analysts.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email bysigning up here.

You can follow Paul on Twitter at@PaulRobinonFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance