FS Bancorp Inc (FSBW) Surpasses Analyst Earnings Projections in Q1, Declares Consecutive Dividend

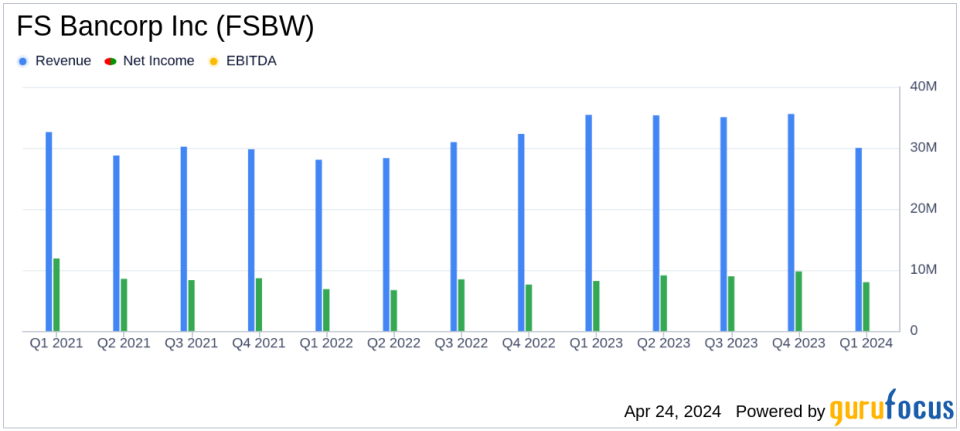

Net Income: Reported $8.4 million for Q1 2024, surpassing the estimated $7.61 million.

Earnings Per Share (EPS): Achieved $1.06 per diluted share, exceeding the estimate of $0.98.

Revenue: Generated $34.46 million in Q1 2024, slightly above the estimated $34.50 million.

Dividends: Declared a quarterly cash dividend of $0.26 per share, marking the forty-fifth consecutive payout.

Total Assets: Increased to $2.97 billion as of March 31, 2024, up 6.7% from the previous year.

Loan Portfolio: Total loans receivable, net grew to $2.42 billion, reflecting a $13.9 million increase from the end of 2023.

Capital Ratios: Maintained well-capitalized status with a CET1 ratio of 10.9% as of March 31, 2024.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On April 24, 2024, FS Bancorp Inc (NASDAQ:FSBW), the holding company for 1st Security Bank of Washington, announced its first-quarter earnings, revealing a net income of $8.4 million, or $1.06 per diluted share. This performance exceeded the analyst estimates which projected earnings of $0.98 per share and a net income of $7.61 million. The company also declared its forty-fifth consecutive quarterly dividend, underscoring its commitment to shareholder value. More details can be found in the company's 8-K filing.

About FS Bancorp Inc

FS Bancorp Inc operates primarily through two segments: Commercial and Consumer Banking, and Home Lending. The company offers a variety of financial products and services, ranging from deposit accounts to residential and commercial lending. It operates 27 bank branches and several loan production offices across Washington and Oregon, servicing a diverse clientele that includes small to mid-sized businesses and individual consumers.

Quarterly Financial Highlights

The first quarter of 2024 saw FS Bancorp achieve a slight increase in net income from $8.2 million in Q1 2023 to $8.4 million. This improvement reflects robust management and strategic operations, even amidst challenging economic conditions. The company's net interest income was reported at $30.3 million, down from $30.7 million in the same quarter the previous year, influenced by increased interest expenses.

FS Bancorp's total assets remained stable at $2.97 billion as of March 31, 2024. The loan portfolio showed healthy growth, with total loans receivable net increasing to $2.42 billion, up from $2.40 billion at the end of 2023. This growth was supported by increases in one-to-four-family and commercial real estate loans, reflecting the company's strong lending capabilities.

Operational and Segment Performance

The Commercial and Consumer Banking segment reported a net income of $8.15 million, while the Home Lending segment contributed $246,000 to the total net income. The diversification in FS Bancorp's revenue streams, through its segments, enhances its stability and capacity to manage sector-specific risks.

Challenges and Strategic Moves

Despite the positive earnings, FS Bancorp faced challenges such as a decrease in net interest margin (NIM) which fell to 4.26% from 4.70% year-over-year. This was primarily due to increased costs of deposits and borrowings, outpacing the yield on interest-earning assets. In response, management has been proactive in adjusting its deposit and loan pricing strategies to align with current market conditions.

Outlook and Forward Movements

Looking ahead, FS Bancorp is positioned to continue its growth trajectory, supported by strategic initiatives such as expanding its loan services and optimizing its capital structure. The consistent payment of dividends reflects confidence in its financial health and commitment to providing shareholder value.

For detailed financial figures and further information, stakeholders are encouraged to refer to the full earnings report and supplementary financial data provided by FS Bancorp.

Contact Information

For more insights and detailed inquiries, please contact Joseph C. Adams, Chief Executive Officer, or Matthew D. Mullet, Chief Financial Officer, at (425) 771-5299 or visit www.FSBWA.com.

Explore the complete 8-K earnings release (here) from FS Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance