Is Freeport-McMoRan Stock Looking Like a Sell on its Risky Indonesian Deal?

Freeport-McMoran (NYSE: FCX) has finally reached an agreement with the Indonesian government for the continuation of its lease on the giant Grasberg mine. The deal, formally announced on August 29, follows months of tense negotiations and public outcries by Indonesia's citizens to have more of a say in how their natural resources are used. The Grasberg mine, one of the largest sources of copper and gold in the world, has been operated by Freeport-McMoRan since the early 1970s. And while the company has spent billions upon billions to develop the mine and the surrounding area, locals claim the wealth has not been shared.

Finally, a conclusion that seems to meet the parties' wishes has been reached. This is a big deal. Grasberg is the source of 25% of Freeport's entire copper production and a staggering 98% of its gold production. And while Freeport's operation may very well be a fruitful one until 2041 (when the new agreement expires), I am less optimistic.

Image source: Freeport-McMoRan.

For decades, Freeport-McMoRan operated in harmony with the Indonesian government. The international mining conglomerate brought expertise and capital, while Indonesia received sizable tax revenues and employment for its citizens. As time went on, however, Indonesia's increasingly democratic government began to assert itself.

The new deal essentially rewrites the original 1972 agreement, which was made between a Freeport predecessor and the military dictatorship that ran Indonesia at the time. The terms of the deal are harsh:

Freeport McMoRan will transfer 51% stake in PT Freeport Indonesia (the subsidiary that runs Grasberg) back to the Indonesian government.

In exchange for this majority-control stake, Freeport will receive fair market value, to be determined later.

Freeport Indonesia's soon-to-expire Contract of Work will be converted into a special license (IUPK), which will provide PT Freeport Indonesia with long-term operating rights through 2041.

Freeport Indonesia will commit to constructing a new smelter in Indonesia within five years.

The Indonesian government will provide certainty of fiscal and legal terms during the term of the IUPK.

These terms are tough, and Indonesia continues to hold all the cards. Making matters worse, Freeport-McMoRan had no choice but to play ball.

Freeport needs Grasberg

Freeport-McMoRan is a truly global mining conglomerate. Unfortunately, its Indonesian operations make up a sizable chunk of its total copper and gold production in two key commodities:

Freeport-McMoRan's 2016 Production Mix (millions of recoverable pounds):

Region | Copper | Gold | Molybdenum |

|---|---|---|---|

North America | 43% | 2% | 74% |

South America | 32% | - | 26% |

Indonesia (Grasberg mine) | 25% | 98% | - |

Data source: Freeport-McMoRan fiscal 2016 annual report.

Freeport-McMoRan Annual Production (in millions of recoverable pounds):

Metal | 2016 | 2015 | 2014 |

|---|---|---|---|

Copper | |||

Production | 4,222 | 3,568 | 3,457 |

Sales, excluding purchases | 4,222 | 3,603 | 3,463 |

Average realized price per pound | $2.28 | $2.42 | $3.09 |

Gold | |||

Production | 1,088 | 1,257 | 1,214 |

Sales, excluding purchases | 1,079 | 1,247 | 1,248 |

Average realized price per pound | $1,238 | $1,129 | $1,231 |

Molybdenum | |||

Production | 80 | 92 | 95 |

Sales, excluding purchases | 74 | 89 | 95 |

Average realized price per pound | $8.33 | $8.70 | $12.74 |

Data source: Freeport-McMoRan fiscal 2016 annual report.

Grasberg is a big part of Freeport's future. The gold ore that it yielded last year grossed the company $1.34 billion of its $14.83 billion in revenue for the year.

Freeport bulls point out that a cloud has been lifted, and that the agreement is proof of management's ability to negotiate with the Indonesian government and come to a mutually beneficial deal. The bears, on the other hand, point to yet another strong negative: the billions of dollars required of Freeport just to keep the mine going.

Closing costs

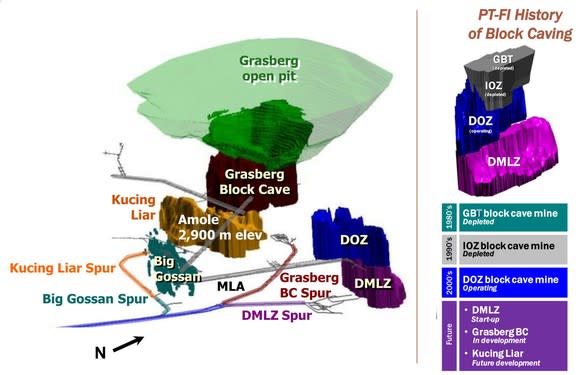

Grasberg is indeed valuable, but it is also entering the latter stages of its useful life. Its first stage, the huge open pit seen above, is depleted. So are the Grasberg Block and IOZ caves. What's an international mining conglomerate to do?

Keep going deeper:

Image source: Freeport McMoRan.

In order to get Grasberg's deeper spur-mines up and running, Freeport is anticipating the need to spend nearly $1 billion per year for the foreseeable future. In its forward capital expenditure projections contained within its Q3 earnings presentation, the company admits that capex projections through fiscal 2019 are total guesses and depend on a satisfactory conclusion to the deal. And these estimates don't even include the smelting operation Indonesia has required the company to construct.

On the other hand, Freeport bulls rightly point to Grasberg's low cost of production and FCX's long history of operating in Indonesia. Freeport's cash costs per-pound in Q3 2017 for its consolidated copper production came to $1.21, up from $1.14 in Q3 2016. Cash costs out of Grasberg costs the company just $1.01 per pound.

Unfortunately, the Indonesia government knows Grasberg is an extremely valuable mine and have long levied sizable taxes on its production. Things like royalties and export duties brought FCX's actual copper production costs up to this figure up to $1.32 in Q3.

The prospect of finding reserves to replace Grasberg are slim as well. As the company noted in its Q3 Earnings Presentation, quality copper discoveries are rare. There just aren't a lot of mines of comparable size and quality in the world. The company has highlighted potential sources of future growth, like its Lone Star Oxide project. Unfortunately, Lone Star is estimated to have cash-costs per pound of copper produced of $1.75 per pound. This is almost certainly why Freeport chose to negotiate with Indonesia's government.

Bottom line

Being asked to sell control of one's business is a tough pill to swallow. The situation becomes all the more absurd when one is asked to invest huge amounts of capital in an operation that it no longer owns a majority stake in. Freeport produced just $1.09 billion in free cash flow (FCF) last year, and investors have to wonder if any and all value derived from Grasberg from this point forward will forever be trapped in Indonesia.

Freeport remains optimistic, and is currently negotiating with Indonesia on a fair price for the 51% of the operation that it is "transferring." But even this chapter in the Grasberg tale may have an unhappy ending. During the company's third-quarter conference call, Freeport's CEO, Richard Adkerson, noted that they were going for a valuation of $13 billion (Freeport won't even get all 51% of the agreed-upon valuation, as Rio Tinto is a minority owner). Alas, in early October, Indonesia's Energy and Mineral Resources Minister Ignasius Jonan said the operation was worth around $8 billion.

With Freeport perpetually stuck between a rock and a hard place, FCX stock looks like a pass.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Sean O'Reilly has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance