Fortive's (FTV) Subsidiary Unveils PVA-1500 Series Curve Tracer

Fortive Corporation’s FTV subsidiary, Fluke Corp, has unveiled the PVA-1500 Series I-V curve tracer. The tracer will enhance the speed and accuracy of utility-scale solar technicians as well as improve testing operations for effective service and maintenance.

The advanced tool aims to address the pressing need for reliable testing of photovoltaic arrays, which, in turn, boosts performance and optimizes returns on investment. The PVA-1500 I-V curve tracers include rapid testing capabilities and precise measurements suitable for high-capacity modules.

The PVA-1500 I-V curve also includes user-friendly operation and a streamlined workflow from setup to analysis, which enhances productivity. Fortive further added that the PVA-1500 is the only I-V Curve Tester capable of consistently and accurately measuring I-V curves for 1500V high-efficiency solar panels without overheating.

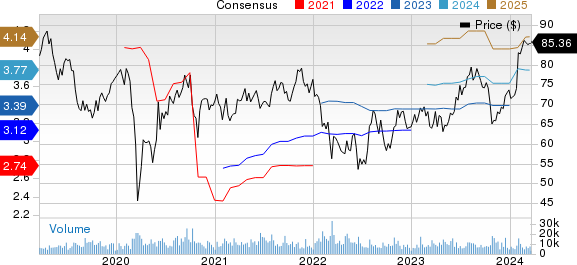

Fortive Corporation Price and Consensus

Fortive Corporation price-consensus-chart | Fortive Corporation Quote

The development of the PVA-1500 series builds upon Fluke's acquisition of Solmetric in September 2023, which included the company’s PV Analyzer. The addition of this tool will allow Fluke to offer a comprehensive toolkit empowering solar professionals to service PV projects across all scales, from microgrids to utility-scale installations.

Fortive is a diversified industrial growth company that provides industrial technology and professional instrumentation solutions on a global basis. The company plans to further grow its business using a five-way strategy. It plans to expand its market position in line with secular growth trends.

In January, the company announced that it had completed the acquisition of a leading company of high-power electronic testing solutions for energy storage, mobility, hydrogen, and renewable energy applications — EA Elektro-Automatik Holding GmbH.

The acquisition will strengthen Tektronix’s unique array of goods and services, which provides engineers with complementary test and measurement solutions to enable the worldwide energy transition. The acquisition is likely to help Fortive to bolster its position in the electronic testing and measurement market.

Fortive currently has a Zacks Rank #3 (Hold). Shares of the company have gained 30% in the past year compared with the sub-industry’s growth of 15.8%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Synopsys SNPS, Woodward WWD and Perion Network PERI. Synopsys and Perion Network sport a Zacks Rank #1 (Strong Buy) at present, while Woodward carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Synopsys’ 2024 earnings per share (EPS) has improved 1.1% in the past 60 days to $13.56. SNPS’ long-term earnings growth rate is 17.5%.

Synopsys’ earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 4.1%. Shares of SNPS have risen 50.3% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 EPS has inched up 5.7% in the past 60 days to $5.27. WWD’s long-term earnings growth rate is 15.5%.

Woodward’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 27.2%. Shares of WWD have risen 51.2% in the past year.

The Zacks Consensus Estimate for Perion Network’s fiscal 2024 EPS has improved 0.6% in the past 60 days to $3.34. PERI’s long-term earnings growth rate is 22%.

The company’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 12.9%. Shares of PERI have lost 39.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Perion Network Ltd (PERI) : Free Stock Analysis Report

Fortive Corporation (FTV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance