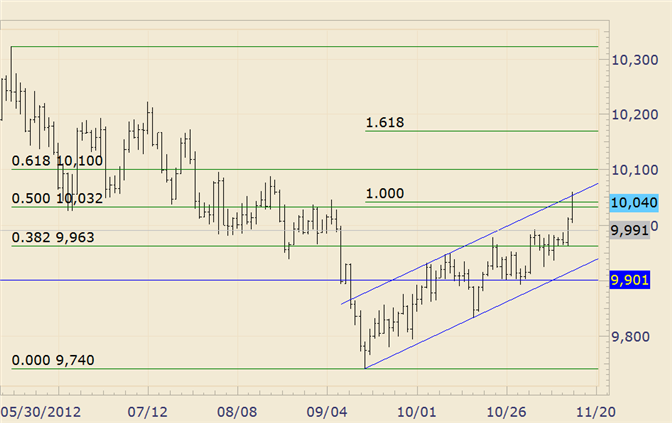

FOREX Technical Analysis: USDOLLAR Rally Stalls at Channel Resistance

Daily Bars

Chart Prepared by Jamie Saettele, CMT

FOREXAnalysis: The Dow Jones FXCM Dollar Index (Ticker: USDOLLAR) low is on the first day of the month thus a more bullish outcome should be respected as long as price is above that level (9901). I wrote yesterday that “Price is now nearing a high risk area for bulls defined by the 100% extension of the rally from the September low, 50% retracement of the decline from the June high, channel resistance, and June low. Expect a reaction.” The reaction at the channel does suggest that this level will not be broken easily. Expect some corrective activity into 10000/20.

FOREX Trading Strategy: I favor buying dips into 10000.

LEVELS: 9961 9991 10020 10060 10100 10173

--- Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow me on Twitter @JamieSaettele

To be added to Jamie’s e-mail distribution list, send an e-mail with subject line "Distribution List" to jsaettele@dailyfx.com

Jamie is the author of Sentiment in the Forex Market.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance