Forex: European Equities Optimistic but European Currencies Lag

ASIA/EUROPE FOREX NEWS WRAP

The Euro was already looking weak headed into the new week, having just come off two days of significant declines in a row as a result of the disappointing European Central Bank Rate Decision on Thursday. With a mix of the potential for a rate cut as well as the increased likelihood that Spain will not take a full sovereign bailout this year, the fundamental backdrop working against the Euro is difficult in the near-term. It got worse this weekend.

Italian Prime Minister Mario Monti, amid a fracturing government due to declining support from former Prime Minister Silvio Berlusconi’s party withdrawing support for the current coalition, has announced his resignation. This could be a major setback for the Italian part of the crisis, with the man booted from office for getting the country into crisis readying to retake control. Since former Prime Minister Berlusconi left office, Italian borrowing costs have plummeted, with the 10-year bond yield shedding over 2% (200-basis points). Despite recession, Italy is expected to meet the European Union’s 3% deficit-to-GDP ratio this year.

The question now is: what will happen if former failed leaders retake control? Silvio Berlusconi is expected to campaign on an anti-austerity, anti-Germany platform, as if to vilify the Monti government that has helped move Italy away from the brink. If you want to know whether or not this is viewed as a positive, there’s nowhere else necessary to look but for the bond markets, which are suggesting that more volatility – and thus uncertainty over Europe – may be ahead in 1Q’13.

Taking a look at European credit, peripheral bond yields are slightly higher, weighing on the Euro to start the week. The Italian 2-year note yield has increased to 2.352% (+41.8-bps) while the Spanish 2-year note yield has increased to 3.036% (+3.0-bps). Likewise, the Italian 10-year note yield has increased to 4.850% (+42.9-bps) while the Spanish 10-year note yield has increased to 5.595% (+17.4-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 12:05 GMT

JPY: +0.29%

NZD: +0.16%

CAD: +0.13%

GBP:-+0.11%

AUD:0.00%

CHF:-0.04%

EUR:-0.16%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.20% (-0.17% past 5-days)

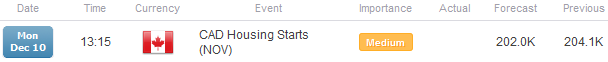

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

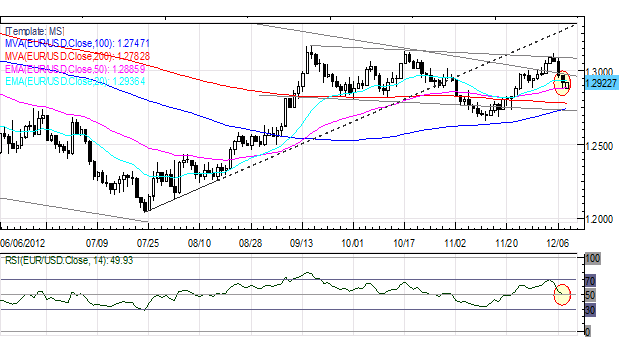

EUR/USD: No change: “The pair has dropped over 200-pips the past few days, and is nearing support near 1.2880/1.2900. Momentum is clearly to the downside, but with 1H and 4H RSI oversold once again, right as the pair comes into its weekly S1 and monthly pivot, a bounce is possible before another move lower occurs. Resistance is at 1.2930/40 (20-EMA) and 1.3010/20. Support is 1.2800/20 (late-September/early-October swing low), 1.2655/65 (November swing low), and 1.2625 (former yearly low).”

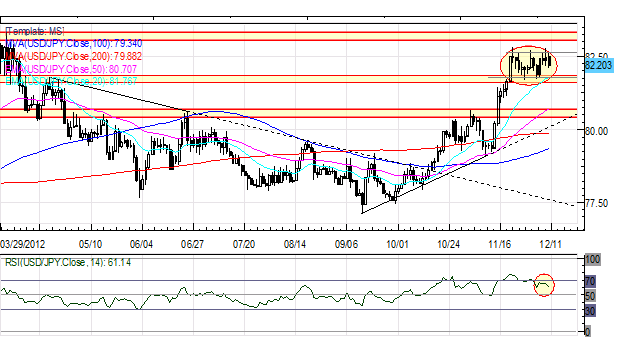

USD/JPY: No change, although the recent consolidation is starting to look like a Bull Flag: “More range-bound price action as the pair fights diametrically opposite fundamental pressures (US fiscal cliff and Japanese elections), thus leaving my levels and outlook at neutral to bullish now. Support comes in at 81.75, 81.15, and 80.50/70 (former November high).Resistance is 82.90/83.00 and 83.30/55.”

GBP/USD: No change from Friday: “Two Dojis and a daily Outside Engulfing candle has led to further downside in the pair after setting fresh December highs on Tuesday. The declines have dragged the GBP/USD below former long-term trendline resistance at 1.6025/35 (descending trendline resistance off of the April 2011 and April 2012 highs). Nevertheless, my levels remain unchanged. Resistance comes in at 1.6125/30 (December high), 1.6170/80 (late-October highs) and 1.6300. Support is 1.6000/25 (20-EMA, 50-EMA), 1.5945/50 (100-DMA), and 1.5860/65 (200-DMA).”

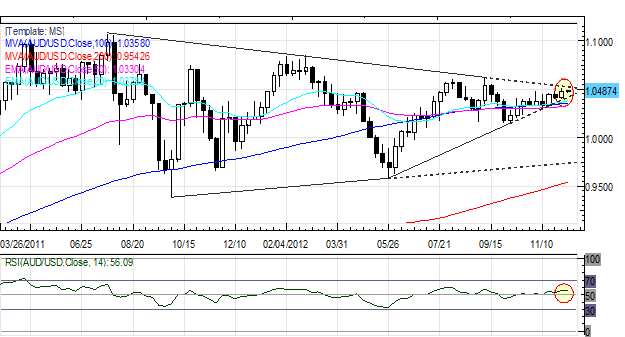

AUD/USD: No change from Friday: “The AUD/USD has started to poke out of its major technical pattern, though until 1.0500/15 is cleared, there’s little reason for excitement. My outlook is thus unchanged: “As the pair has traded towards its Symmetrical Triangle termination point, and appears to be making a move to the upside; when considered in the big picture, the current pause witnessed the past year or so may be viewed as a consolidation. Support is at 1.0435/45 (held today, weekly R1, trendline support off of the June 1 and October 23 lows) and 1.0235/80. Resistance is 1.0475/90 (November high) and 1.0500/15.” Note: this is a weekly chart to highlight how close the AUD/USD to a potential breakout.

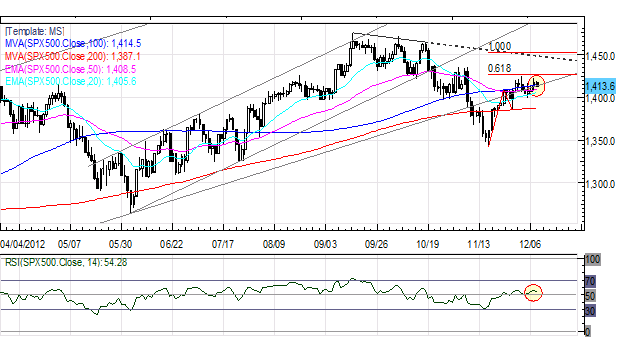

S&P 500: No change: “Is the uptrend over? Although the rally off of the 61.8 Fibonacci retracement (June 2012 low to September 2012 high) carried the S&P 500 back into a confluence of resistance at 1400/10 (20-EMA, 50-EMA, 100-EMA), the measured move off of the low suggested a top at 1425 given the 61.8 Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension. Support comes in at 1387 (200-DMA) and 1345/50 (November low). A move higher eyes 1425, 1450, and 1460.”

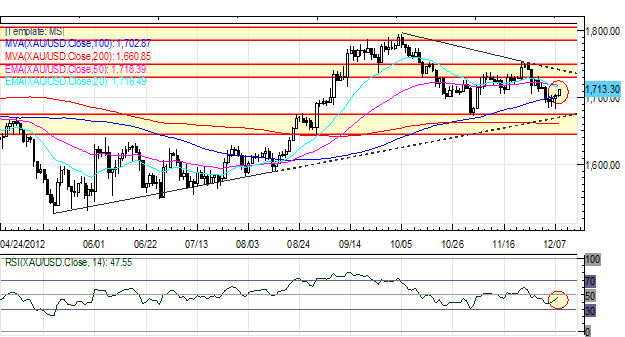

GOLD: No change: “Gold has fallen back off of its November and December highs near 1735, mainly on progress over the US fiscal cliff and demand for US Dollars amid the need to diversify away from the Japanese Yen. I still expect the 1700 area to be defended vigorously on declines, and will continue to look to get long as low as 1675. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700 (breaking now), 1690/95 (100-DMA, November low), and 1660/65 (200-DMA).”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance