Flughafen Zuerich AG's Dividend Analysis

Assessing the Sustainability and Growth of Flughafen Zuerich AG's Dividends

Flughafen Zuerich AG (FLGZY) recently announced a dividend of $0.24 per share, payable on 2024-05-13, with the ex-dividend date set for 2024-04-24. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into Flughafen Zuerich AG's dividend performance and evaluate its sustainability.

Understanding Flughafen Zuerich AG

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

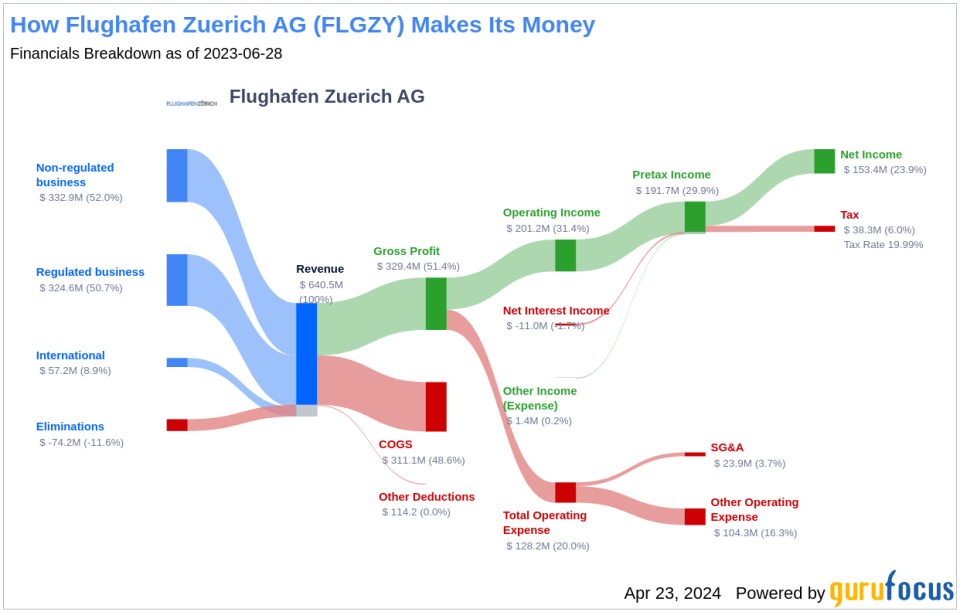

Flughafen Zuerich AG operates Zurich Airport, providing services for international, domestic, and regional flights. It generates revenue through aviation servicesprimarily from passenger and landing feesand non-aviation services, including retail and parking charges, facility management, and other airport services. With the majority of its passengers traveling within Europe, the company has positioned itself as a key hub for European travel, particularly to popular tourist destinations.

Flughafen Zuerich AG's Dividend Track Record

Flughafen Zuerich AG has maintained a consistent dividend payment record since 2023, distributing dividends annually. Although specific data regarding the increase of dividends each year since a particular year is not available, the company's commitment to providing shareholder value through dividends is evident. The annual Dividends Per Share chart below showcases Flughafen Zuerich AG's historical trends in dividend payments.

Dividend Yield and Growth Prospects

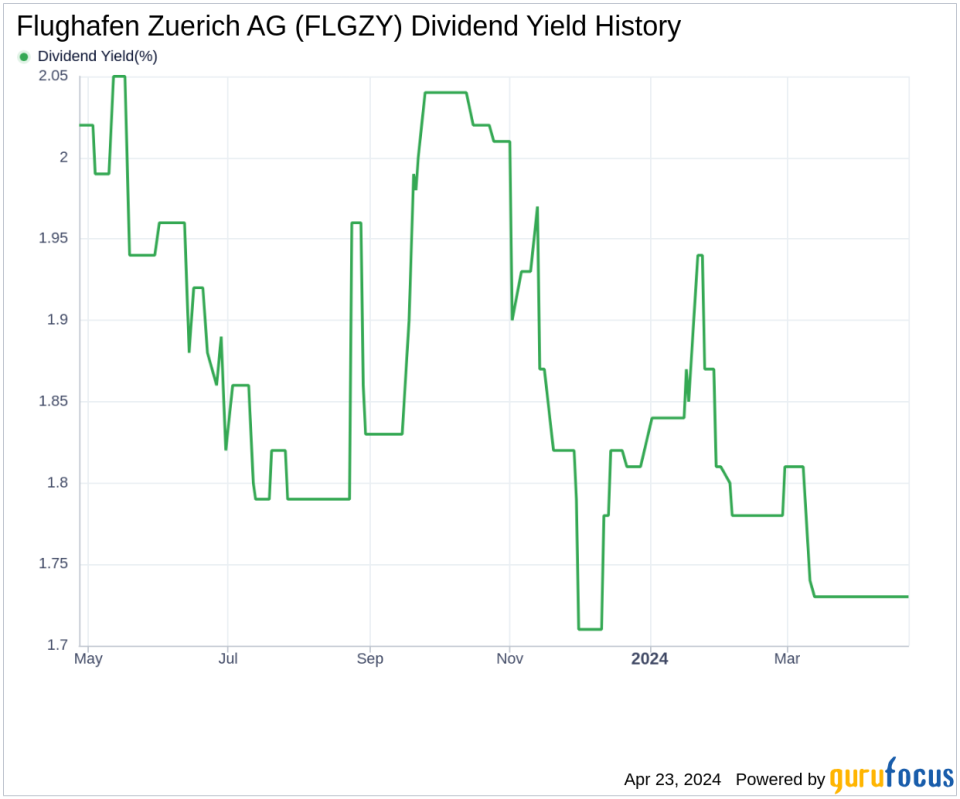

As of today, Flughafen Zuerich AG boasts a 12-month trailing dividend yield of 1.73% and a 12-month forward dividend yield of 2.69%. This forward-looking metric anticipates an increase in dividend payments over the next year. The company's 5-year yield on cost is also at 1.73%, reflecting the return on investment from dividends based on the original purchase price of the stock.

Evaluating Dividend Sustainability

When assessing dividend sustainability, the dividend payout ratio is a crucial metric. Flughafen Zuerich AG's payout ratio stands at 0.33 as of December 31, 2023, indicating a balanced approach to distributing earnings and retaining capital for growth. The company's profitability rank is 7 out of 10, suggesting healthy profitability compared to peers. With a track record of net profit in 8 out of the past 10 years, Flughafen Zuerich AG's financial stability supports its dividend policy.

Forecasting Growth and Dividend Continuity

For dividends to be sustainable, underlying company growth is essential. Flughafen Zuerich AG's growth rank of 7 out of 10 indicates a favorable growth trajectory. The company's revenue per share and 3-year revenue growth rate reveal a robust revenue model, with an average annual increase of 25.60%, outperforming approximately 82.83% of global competitors.

Conclusion: The Outlook for Flughafen Zuerich AG's Dividends

In conclusion, Flughafen Zuerich AG's upcoming dividend payment, consistent dividend history, and positive growth metrics provide a compelling case for value investors. The company's prudent payout ratio and solid profitability underscore the potential for ongoing dividend payments and growth. Investors considering Flughafen Zuerich AG should weigh these factors against their investment strategy and the broader market context. As always, it is advisable to conduct thorough research or consult with a financial advisor. For those seeking high-dividend yield opportunities, the High Dividend Yield Screener available to GuruFocus Premium users can be an invaluable tool.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance